Sustainable investing for financial advisers

The Sustainable Impact Model Portfolio Service (SIMPS)

As an adviser, you’ll have a range of clients with a variety of investment objectives. Our Sustainable Impact Model Portfolio Service (SIMPS) offers an authentic, sustainable impact focused solution for your clients seeking an investment model which does well, and does good. Over the years we’ve seen that:

- Financial and impact returns can sit alongside each other and further support the causes your clients care about.

- Demand for a genuine sustainable impact investment solution continues to grow as more investors want their investments to align with the things they care about.

- Sustainable impact investments can help diversify a portfolio, providing a new asset class that can help diversify and reduce overall risk.

We have a library of resources available to help advisers support their business and clients. Follow the prompts above.

1. Engaging your client

A great starting point to cut through the sustainable impact investing jargon and find tools to connect clients with an investment model which does well and does good.

2. Recommending a SIMPS portfolio

Whether it’s a new prospect or a client you’ve looked after for decades, here you’ll find resources to help with your portfolio specific recommendations to clients.

3. Your ongoing support

Here you have access to assets to help with yours, and your clients, understanding of sustainable impact investing and the SIMPS portfolios.

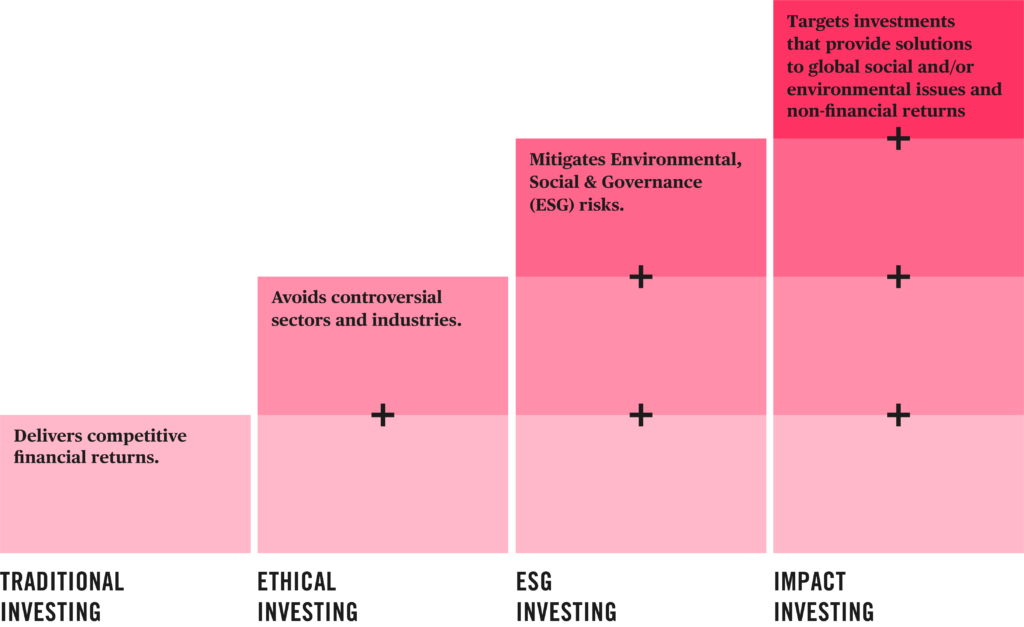

Why impact investing?

Impact Investing

It’s often a way for investors to express their personal values through their investments: using business to solve social and/or environmental problems.

Latest CPD webinars

We host regular webinars for our adviser community on a variety of investment and impact topics. To be invited to our upcoming webinars – please email advisers@tribeimpactcapital.com

In May 2024, the FCA launched an anti-greenwashing rule targeting misleading sustainability claims by FCA-authorised firms, including financial advisers. This webinar, lead by Tribe’s Head of Compliance, Olivia Shaw, will clarify the rule for all financial advice firms. We’ll explore the rule’s impact, adviser requests, and adjustments needed for compliance.

We’ll focus on:

- Insights into the FCA’s anti-greenwashing rule

- Its effects on financial advisers

- Useful tools and resources

Eligible for 30 minutes of unstructured CPD.

We’ll discuss the latest investment performance and outlook for the Sustainable Impact MPS (SIMPS) portfolios, including:

- The macro-economic environment and what is driving financial markets

- Review of Q2 performance and outlook for upcoming quarters

- Asset allocation and portfolio changes

- Q&A

Hosted by Christopher Toy, Business Development Manager and Fred Kooij, Chief Investment Officer

Eligible for 30 minutes of unstructured CPD.

We’ll discuss the latest investment performance and outlook for the Sustainable Impact MPS (SIMPS) portfolios, including:

- The macro-economic environment and what is driving financial markets

- Review of Q1 performance and outlook for upcoming quarters

- Asset allocation and portfolio changes

- Q&A

Hosted by Aaron Gaide, Business Development Manager and Rob Hurford, Chief Investment Officer

Eligible for 30 minutes of unstructured CPD.

We’ll discuss the latest investment performance and outlook for the Sustainable Impact MPS (SIMPS) portfolios, including:

- The macro-economic environment and what is driving financial markets

- Review of Q4 performance and outlook for upcoming quarters

- Asset allocation and portfolio changes

- Q&A

Hosted by Christopher Toy, Business Development Manager and Fred Kooij, Chief Investment Officer

Eligible for 30 minutes of unstructured CPD.

During this session, Ray Dhirani, Tribe Impact Capital and My-Linh Ngo, Bluebay Asset Management will share valuable insights into leveraging fixed income instruments for impactful and sustainable outcomes. Discover how assets in the SIMPS portfolios can contribute to positive social and environmental change without compromising financial returns.

We’ll focus on:

- Why is fixed income relevant when it comes to sustainable investing?

- What are the differences when it comes to primary and secondary market opportunities? Are they delivering similar levels of impact?

- What are some examples of holdings that have delivered positive results for society and the environment in the past?

- Q&A

Hosted by Business Development Manager Aaron Gaide, joined by two key speakers: Tribe’s Head of Impact Management, Ray Dhirani, and BlueBay Asset Management’s Senior Director & Impact-Aligned Strategist, Responsible Investment, My-Linh Ngo. The BlueBay Impact-Aligned Bond Fund is a recent addition to Tribe’s Sustainable Impact Model Portfolio Service (SIMPS).

Eligible for 30 minutes of unstructured CPD.

We’ll discuss the latest investment performance and outlook for the Sustainable Impact MPS (SIMPS) portfolios, including:

- The macro-economic environment and what is driving financial markets

- Review of Q2 performance and outlook for upcoming quarters

- Asset allocation and portfolio changes

- Q&A

Hosted by Christopher Toy, Business Development Manager and Jamie Innes, Investment Manager

Eligible for 30 minutes of unstructured CPD.

In partnership with Lee Coates OBE, from ESG Accord, join us as we examine the ongoing regulation changes for the financial advice industry.

We’ll look at how advisers could be affected, with a specific focus on:

- What are the FCA’s Sustainability Disclosure Requirements (SDR) and new labels for sustainable investments?

- How does consumer duty intersect with the sustainable finance rules?

- When will these changes come through and what should advisers do?

Hosted by Business Development Managers Aaron Gaide and Christopher Toy, along with special guest Lee Coates OBE, Co-founder of ESG Accord.

Eligible for 30 minutes of unstructured CPD.

The Inflation Reduction Act allocates more than US$370 billion in incentives and programmes to accelerate action on climate and energy over the next decade.

In this session, we’ll break-down what this means for investors and the Tribe SIMPS, including:

- What is the Inflation Reduction Act? And why is it so important?

- What does it mean for investors and climate change?

- Which sectors and companies will benefit from the policy action?

- What can we expect in the future?

Hosted by Christopher Toy, Business Development Manager, Jamie Innes, Investment Manager and Rob Hurford, Investment Analyst

Eligible for 30 minutes of unstructured CPD.

The war in Ukraine has reminded governments and investors that goals to decarbonise and promote energy efficiency are linked to geopolitical energy security requirements.

In this webinar Tribe’s Chief Investment Officer, Fred Kooij considers:

- What are governments doing to accelerate investment away from fossil fuels?

- Which sectors and industries are critical to support the shift away from fossil fuels?

- What are the implications and outlook for the SIMPS portfolios?

Hosted by Aaron Gaide, Business Development Manager and Fred Kooij, Chief Investment Officer.

Eligible for 30 minutes of unstructured CPD.

In this webinar, with Lee Coates OBE, Co-founder of ESG Accord, we discuss some of the current challenges advisers are facing:

- What are the existing rules around sustainability and suitability and how do you ensure you’re compliant?

- Where is the FCA regulation heading and what does it mean for advisers and their advice process?

- How do you ‘ask the question’ and what to do with the answer?

Hosted by Christopher Toy, Business Development Manager and Lee Coates OBE, Co-founder of ESG Accord.

Eligible for 30 minutes of unstructured CPD.

Join the Tribe

Start realising the potential of the SIMPS by speaking to our advisers team today.