SIMPS investment approach

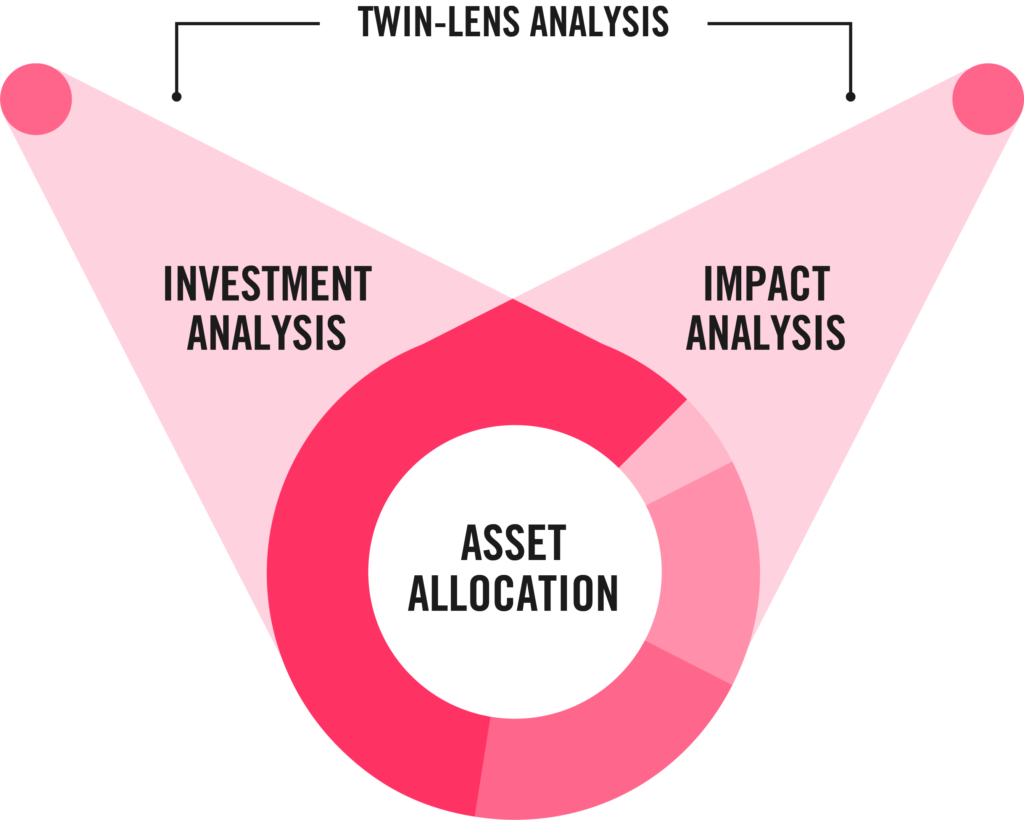

At Tribe, every investment is assessed for both financial performance and the ability to deliver long term positive impact.

We call this our ‘

Twin-lens

This isn’t just about negative screens; it doesn’t simply mean ruling out investing in companies with bad practices. Instead, our approach takes a much more detailed view of which opportunities may have

a positive impact and generate financial returns.

These due diligence processes — of investment and impact — run together in parallel to understand the merits and/or potential risks of an investment. This approach allows us to ensure that the long-term impact goals of the people who invest with us are being met alongside their financial ones.

Investment lens

When evaluating each security, we focus on a set of core financial indicators that signal strength, resilience, and long-term potential. These help us understand how well a company is run, how effectively it allocates capital, and whether it can sustain growth over time.

Impact lens

At Tribe, impact means aligning investments to the desired outcomes of the

UN Sustainable Development Goals (UN SDGs)

Investing in a purposeful portfolio

Choose a SIMPS portfolio that gives your clients financial, social and environmental returns. The SIMPS portfolios are aligned to the UN SDGs, allowing your clients to identify the impact they’re creating in the world.

2. Zero Hunger

Key statistics

- Approximately 828 million people are suffering from hunger – 1 in 10 people.

- 2.4 billion people experience moderate to severe food insecurity worldwide, meaning they lack regular access to adequate food.

- If current trends persist, 1 in 5 children under age 5 will be affected by stunting – impaired growth and development due to poor nutrition – in 2030.

Targets

- End hunger and ensure all people have access to safe, nutritious and sufficient food all year round.

- End all forms of malnutrition, and address the nutritional needs of adolescent girls, pregnant and lactating women and older people.

- Double the agricultural productivity and incomes of small-scale food producers, particularly women, indigenous people, family farmers and fishers.

- Ensure food production systems are sustainable and implement resilient agricultural practices that increase productivity and production, help maintain ecosystems and strengthen capacity for adaptation to climate change.

Sustainable Communities

Education and Equality focuses on the social fabric needed to ensure everyone thrives; the social foundation.

3. Good Health and Well-being

Key statistics

- A woman dies every 2 minutes from preventable causes related to pregnancy and childbirth.

- Out-of-pocket payments for health pushed or further pushed 381 million people (almost 5% of the population) into extreme poverty.

- More than 9 in 10 deaths caused by air pollution occur in lower- and middle-income countries.

Targets

- Reduce the global maternal mortality ratio to less than 70 per 100,000 live births.

- End preventable deaths of newborns and children under 5, with all countries aiming to reduce neonatal mortality to at least as low as 12 per 1,000 live births and under 5 mortality to at least as low as 25 per 1,000 live births.

- End the epidemics of AIDS, tuberculosis, malaria and neglected tropical diseases. Combat hepatitis, water-borne diseases and other communicable diseases.

- Ensure universal access to sexual and reproductive health-care services.

Sustainable Communities

Education and Equality focuses on the social fabric needed to ensure everyone thrives; the social foundation.

4. Quality Education

Key statistics

- To meet national 2030 education targets, countries must annually enrol 1.4 million children in early childhood education, admit a new child to school every 2 seconds until 2030 and triple annual progress in primary completion rates.

- Without additional measures, by 2030, 84 million children and youth will be out of school, 300 million will lack numeracy/literacy skills and only 1 in 6 countries will achieve the universal secondary school completion target.

- Low- and lower-middle-income countries face a nearly $100 billion annual financing gap to reach their education targets.

Targets

- Ensure that all girls and boys complete free, equitable and quality primary and secondary education.

- Ensure that all youth and a substantial proportion of adults, both men and women, achieve literacy and numeracy.

- Eliminate gender disparities in education and ensure equal access to all levels of education for all people.

- Build and upgrade education facilities that are child, disability and gender sensitive and provide safe, non-violent, inclusive and effective learning environments for all.

Sustainable Communities

Education and Equality focuses on the social fabric needed to ensure everyone thrives; the social foundation.

5. Gender Equality

Key statistics

- The world is not on track to achieve gender equality by 2030. At the current rate, it will take: 300 years to end child marriage, 286 years to close gaps in legal protection and remove discriminatory laws, and 140 years to achieve equal representation in leadership in the workplace.

- 1 in 5 young women are married before their 18th birthday.

- Women carry an unfair burden of unpaid domestic and care work, spending 2.5 times more hours a day on it than men.

Targets

- End all forms of discrimination against all women and girls everywhere.

- Eliminate all forms of violence against all women and girls in the public and private spheres, including trafficking and exploitation.

- Eliminate all harmful practices, such as child, early and forced marriage and female genital mutilation.

- Ensure women’s full and effective participation and equal opportunities for leadership at all levels of decision-making in political, economic and public life.

Sustainable Communities

Education and Equality focuses on the social fabric needed to ensure everyone thrives; the social foundation.

6. Clean Water and Sanitation

Key statistics

- Safe drinking water and sanitation are still out of reach for billions of people – at the current speed, in 2030, 2 billion people will still live without safely managed drinking water, 3 billion without safely managed sanitation and 1 billion without basic hygiene services.

- 2.4 billion people live in water-stressed countries.

- 81% of species dependent on inland wetlands have declined since 1970.

Targets

- Achieve universal and equitable access to safe and affordable drinking water for all.

- Achieve access to adequate and equitable sanitation and hygiene for all.

- Improve water quality by reducing pollution, eliminating dumping and minimising the release of hazardous chemicals and materials.

- Substantially increase water-use efficiency across all sectors and ensure sustainable withdrawals and supply of freshwater to address water scarcity and reduce the number of people suffering from water scarcity.

Sustainable Ecosystems

Environment & Ecology focuses on the boundaries that Nature sets; the ecological ceiling or planetary boundary.

7. Affordable and Clean Energy

Key statistics

- 675 million people still live in the dark.

- If current trends continue, 1 in 4 people will still use unsafe and inefficient cooking systems by 2030.

- International public financing for clean energy for developing countries continues to decline – down $16.4 billion between 2017 and 2021.

Targets

- Ensure universal access to affordable, reliable and modern energy services.

- Substantially increase the share of renewable energy in the global energy mix.

- Enhance international cooperation to facilitate access to clean energy research and technology.

- Expand infrastructure and upgrade technology for supplying modern and sustainable energy services for all in developing countries.

Sustainable Ecosystems

Environment & Ecology focuses on the boundaries that Nature sets; the ecological ceiling or planetary boundary.

8. Decent Work and Economic Growth

Key statistics

- 2 billion workers – 58% of the global workforce – are in precarious, informal jobs without social protection.

- 1 in 4 young people are not in education, employment or training, with young women more than twice as likely as young men to be in this situation.

- Women and youth face higher unemployment rates. In 2023, gender unemployment gaps remained similar to those in 2015 and youth unemployment was more than 3x higher than adult unemployment rates globally (3.7% vs 13.0% respectively).

Targets

- Achieve higher levels of economic productivity through diversification, technological upgrading and innovation.

- Achieve full and productive employment and equal pay for work of equal value for all people.

- Sustain per capita economic growth in accordance with national circumstances and, in particular, at least 7% GDP growth per year in the least developed countries.

- Promote policies that support productive activities, job creation, entrepreneurship, creativity and innovation.

Sustainable Communities

Education and Equality focuses on the social fabric needed to ensure everyone thrives; the social foundation.

9. Industry, Innovation and Infrastructure

Key statistics

- Energy-related CO2 emissions reached 36.8 billion metric tonnes in 2022, a record high.

- The industry’s recovery from the COVID-19 pandemic remains incomplete and uneven. Global manufacturing growth slowed down to 3.3% in 2022, from 7.4% in 2021.

- Least Developed Countries (LDCs) are likely to miss their 2030 target of doubling their manufacturing share of GDP.

Targets

- Develop sustainable and resilient infrastructure, to support economic development and human well-being, with a focus on equitable access for all.

- Upgrade infrastructure to increase resource-use efficiency and adoption of clean and environmentally sound technologies.

- Enhance scientific research and upgrade the technological capabilities of industrial sectors in all countries, in particular developing countries.

- Significantly increase access to information and communications technology and strive to provide universal and affordable access to the Internet in least developed countries.

Sustainable Communities

Education and Equality focuses on the social fabric needed to ensure everyone thrives; the social foundation.

10. Reduced Inequalities

Key statistics

- Developing countries are not fairly represented in international economic decision-making. Strengthening their voice and participation is crucial to ensuring a more inclusive and equitable global economic system.

- For the first time this century, half of the 75 most vulnerable countries face a widening income gap with the wealthiest economies.

- In 2022, refugee numbers hit a record high of 34.6 million people. Among them, 41% were children.

Targets

- Achieve and sustain income growth of the bottom 40% of the population at a rate higher than the national average.

- Empower and promote the social, economic and political inclusion of all.

- Ensure equal opportunity and reduce inequalities by eliminating discriminatory laws, policies and practices.

- Ensure enhanced representation and decision-making for developing countries in global economic and financial institutions.

Sustainable Communities

Education and Equality focuses on the social fabric needed to ensure everyone thrives; the social foundation.

11. Sustainable Cities and Communities

Key statistics

- 1.1 billion urban residents are living in slums. 2 billion more are expected in the next 30 years.

- Globally, 3 in 4 cities have less than 20% of their area dedicated to public spaces and streets.

- In the developing world, 1 billion people lack access to all-weather roads.

- Globally, only 1 in 2 urban residents have convenient access to public transport.

Targets

- Ensure access for all to adequate, safe and affordable housing and basic services and upgrade slums.

- Provide access to safe, affordable, accessible and sustainable transport systems for all.

- Reduce the adverse environmental impact of cities, by paying special attention to air quality and municipal and other waste management.

- Provide universal access to safe, inclusive and accessible, green and public spaces.

Sustainable Ecosystems

Environment & Ecology focuses on the boundaries that Nature sets; the ecological ceiling or planetary boundary.

12. Responsible Consumption and Production

Key statistics

- High-income countries leave a larger environmental footprint compared to low-income countries – 10x that of low-income countries.

- Each year, food loss and waste generate 8-10% of greenhouse gas emissions, costing over $1 trillion and straining land resources and biodiversity.

- Globally, an estimated 1 billion meals of edible food are wasted every day, equivalent to 1.3 meals per person impacted by hunger per day.

Targets

- Achieve the sustainable management and efficient use of natural resources.

- Halve per capita global food waste at the retail and consumer levels, and reduce food losses along production and supply chains.

- Achieve the environmentally sound management of chemicals and all waste throughout their life cycle, and significantly reduce their release to air, water and soil.

- Encourage companies, especially large and transnational companies, to adopt sustainable practices and integrate sustainability information into their reporting cycle.

Sustainable Ecosystems

Environment & Ecology focuses on the boundaries that Nature sets; the ecological ceiling or planetary boundary.

13. Climate Action

Key statistics

- The rate of sea-level rise has doubled in the last decade.

- Highly vulnerable regions, including least developed countries (LDCs) experience 15x higher mortality rates from climate disasters compared to very low vulnerability regions.

- The energy sector, responsible for 86% of global CO2 emissions, remains the largest contributor, driven by the expansion of coal- and gas-fired power generation.

Targets

- Strengthen resilience and adaptive capacity to climate-related hazards and natural disasters in all countries.

- Integrate climate change measures into national policies, strategies and planning.

- Improve education on climate change mitigation, adaptation, impact reduction and early warning.

- Promote mechanisms for raising capacity for effective climate change-related planning and management in least developed countries and small island developing States.

Sustainable Ecosystems

Environment & Ecology focuses on the boundaries that Nature sets; the ecological ceiling or planetary boundary.

14. Life Below Water

Key statistics

- 1 in 5 fish caught originates from illegal, unreported and unregulated fishing.

- 90% of coral could be lost by 2050 at 1.5°C of warming and up to 99% at 2°C. The survival of coral reefs is vital for ocean health and humanity’s well-being.

- Oceans contain nearly 200,000 identified species and absorb around 30% of CO2 produced by humans.

Targets

- Prevent and significantly reduce marine pollution of all kinds.

- Sustainably manage and protect marine and coastal ecosystems, including by strengthening their resilience, and taking action for their restoration.

- Minimise and address the impacts of ocean acidification.

- Effectively regulate harvesting and end overfishing, illegal, unreported and unregulated fishing and destructive fishing practices.

Sustainable Ecosystems

Environment & Ecology focuses on the boundaries that Nature sets; the ecological ceiling or planetary boundary.

15. Life on Land

Key statistics

- Protected area coverage of key biodiversity areas has stalled since 2015.

- The world is currently facing the largest species extinction event since the dinosaur age.

- Over 44,000 species – or 28% of almost 160,000 assessed species – are currently threatened.

Targets

- Ensure the conservation, restoration and sustainable use of terrestrial and inland freshwater ecosystems and their services, in particular forests, wetlands, mountains and drylands.

- Promote the sustainable management of all types of forests, halt deforestation, restore degraded forests and substantially increase afforestation and reforestation globally.

- Combat desertification; restore degraded land and soil, including land affected by desertification, drought and floods.

- Mobilise and significantly increase financial resources to conserve and sustainably use biodiversity and ecosystems.

Sustainable Ecosystems

Environment & Ecology focuses on the boundaries that Nature sets; the ecological ceiling or planetary boundary.

16. Peace, Justice and Strong Institutions

Key statistics

- All SDGs depend on establishing lasting peace and preventing violent conflicts. Urgent action is needed to combat corruption and organized crime, strengthen the rule of law and access to justice, build effective and inclusive governance institutions, and protect rights and fundamental freedoms.

- The number of forcibly displaced people reached an unprecedented 120 million in May 2024.

- Civilian casualties in armed conflicts surged by 72% in 2023.

Targets

- Significantly reduce all forms of violence and related death rates everywhere.

- End abuse, exploitation, trafficking and all forms of violence against and torture of children.

- Promote the rule of law at the national and international levels and ensure equal access to justice for all.

- Significantly reduce illicit financial and arms flows, strengthen the recovery and return of stolen assets and combat all forms of organised crime.

17. Partnerships for the Goals

Key statistics

- Developing countries face a $4 trillion annual investment gap to achieve the SDGs. The Secretary-General has urged countries to support an SDG Stimulus of at least $500 billion annually.

- About 60% of low-income countries are at high risk of debt distress or already experiencing it.

- Globally, 1 in 3 people are still offline, underscoring the urgency of infrastructure investments and affordable Internet access, particularly in underdeveloped regions.

Targets

- Strengthen domestic resource mobilisation, including international support to developing countries.

- Assist developing countries in attaining long-term debt sustainability through coordinated policies.

- Adopt and implement investment for least developed countries.

- Enhance global macroeconomic stability, including through policy coordination and policy coherence.