SDG Performance Report (2020-2021)

We’re delighted to present our third Sustainable Development Goal (SDG) Performance Report. This reporting year 1 has been one of the most extraordinary years in human history. The Covid-19 pandemic effectively brought the world to a standstill in March 2020, and since then, has imposed lockdowns in most countries around the world. As vaccines have been rolled out, the world is slowly re-emerging; but things are not how they were before. The pandemic has laid bare the frailties of communities and societies around the world, highlighting health and economic inequalities and inequities. The past 18 months have hopefully taught us vital lessons and, in some areas, led to what we hope will be the start of a completely new way of doing business and finance.

The extraordinary growth of Environmental Social and Governance (ESG) investing over the last 18 months certainly points to a sizeable shift in the investment psychology in the markets. It’s clear to us that ESG alone won’t get us to where we need to get to – the delivery of the

UN Sustainable Development Goals (UN SDGs)

The last 18 months have also witnessed an acceleration in the speed and scale of the ecosystem changes we are witnessing, particularly evident with the climate. The Australian “Black Summer”

bushfires in 2019-2020

2

, the record-breaking

fires in North America

3

and the most powerful landed

super typhoon Goni (Rolly) in the Philippines

4

with measured winds of 195mph are just some events that remind us of the severity of the

Climate crisis

We recently submitted our

B Corporation (B Corp) recertification assessment

5

and we await the outcomes of that. We’re also working to develop our

Science Based Target (SBT)

6

after the methodology for the finance sector was released in November 2020. We enjoyed beta testing the tools that the SBT team developed before the launch of the methodology. We also put forward our annual

Principles for Responsible Investing (PRI)

7

submission which outlines our approach to sustainable and impact investing across all of our assets. The latter part of this reporting year saw us change

and we’ve been working with them to increase the breadth and depth of our

Active ownership

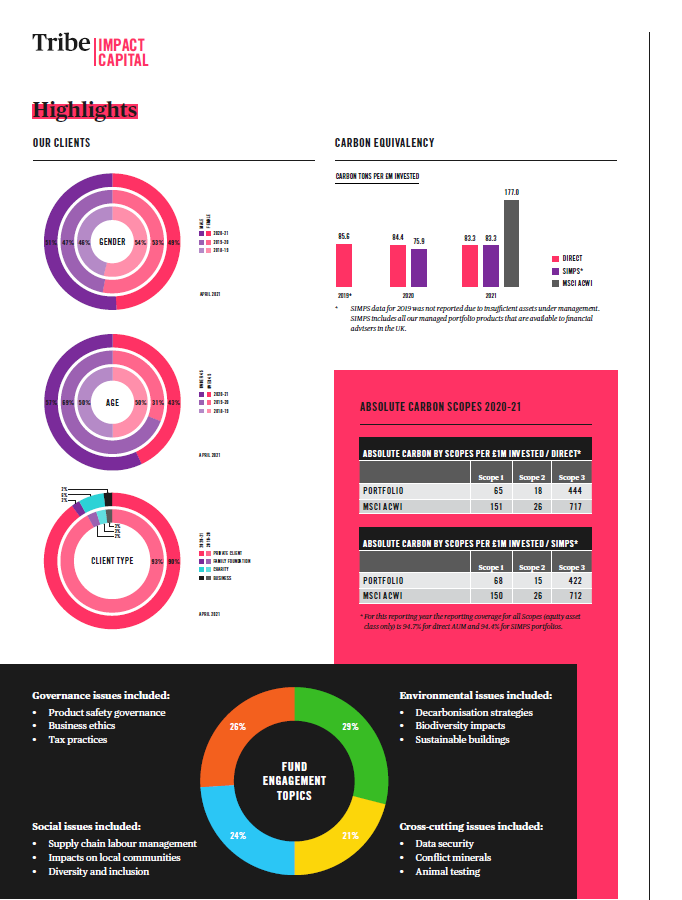

We’re thrilled to report that our assets under management between May 2020 and April 2021 again more than doubled. All our assets remain 100% managed for social and environmental impact. The style and metrics included in this report remain consistent with our previous reports to enable comparison and tracking of our performance. We will however, move away from this format in our next report for our investments section. This is because our commitment to agree and deploy our approved SBT across our business will shift the way we report our Paris Climate Agreement alignment. Next year we’ll also present for the first time our active ownership and voting records enabled by our change of custodian. There’s a lot of change happening in impact and investment performance reporting, and we constantly strive to incorporate developments into our reporting and disclosures.

During this reporting year we committed to becoming a

Future Fit Pioneer

8

and will report on our progress later this year. The

Future-Fit Business Benchmark

Since Tribe started in summer 2016, we’ve taken our pledge to being transparent seriously. We’ve committed, mainly through our B Corp submissions, and our annual UN Principles for

Responsible Investing