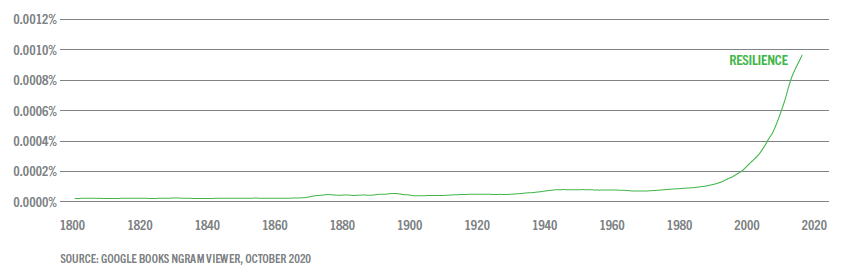

Investing for resilience

Use of the term ‘resilience’ in global literature has risen exponentially in recent decades. 1

Today, the concept of resilience is applied in a range of contexts from ecology and disaster management to cyber security, mental health and engineering. Resilience is also at the forefront of discussions about the global post Covid-19 recovery and our collective efforts to build back better. In this paper, we explore the evolution of resilience as a concept, why it’s essential today, and how it can be applied as a lens for impact investing.

At Tribe, we focus on many forms of resilience. We divide our range of resilience based investment opportunities into three categories which are integral to facilitating the systems change we want to see: infrastructural, planetary and human resilience:

Infrastructural Resilience: to strengthen our man-made environment and improve its capacity to withstand the various potential social-ecological disruptions on the horizon.

Digital Innovation: Digital technology and software has the unique ability to support the delivery of all 17

UN Sustainable Development Goals (UN SDGs)

Sustainable Construction: Our conventional modes of construction need to be reimagined as buildings currently account for roughly

39% of global energy-related carbon emissions

4

as well as significant volumes of water and material consumption. Numerous initiatives have been developed and are being used to promote the delivery of resource efficient buildings and refurbishments including, among others, the Passivhaus standard and the Dutch Energiesprong model. Technologies like high performance insulation, natural ventilation and heat recovery systems, natural daylighting systems, greywater recycling and onsite renewable power generation, to name a few, can be used to significantly reduce the operational resource footprint of buildings. Digital innovation also has a role to play in smart energy and water management systems which can drastically improve resource efficiency.

Beyond their operational impacts, buildings made using cement and concrete account for significant volumes of embodied carbon. A wide range of bio-based, renewable and recyclable materials show promise as alternative building materials, from

bamboo,

5

hemp,

6

straw,

7

and

mycelium,

8

to

cork,

9

seaweed

10

and sustainably-sourced timber. Many of these are effective at locking in sequestered carbon and supporting

Biodiversity

Clean and

Renewable energy

The electrification of the transport sector is another essential infrastructural shift, and one that relies on affordable and reliable access to renewable power in order to deliver decarbonisation benefits alongside reductions in ambient air pollution. Electric vehicles will play a central role together with the promotion of walking, cycling and public transport. Innovations in vehicle-to-grid technology highlight the potential for electric vehicle batteries to help balance out power supply and demand while charging, which will enable the integration of more renewable power into the electricity grid. In addition to electrification, innovative fuels like

Green hydrogen

Footnotes

-

books.google.com/ngrams/graph?content=resilience&year_start=1500&year_end=2019&corpus=26&smoothing=3Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote