SDG Performance Report (2021-2022)

We’re pleased to present our fourth

UN Sustainable Development Goals (UN SDGs)

Sustainable Finance Disclosure Regulation (SFDR)

In happy news, we recertified as a

B Corporation (B Corp)

Our proposed

SBTi methodology for Financial Services

The UN Principles for Responsible Investment (PRI) paused submissions for this reporting year so there has been no update requested of us.

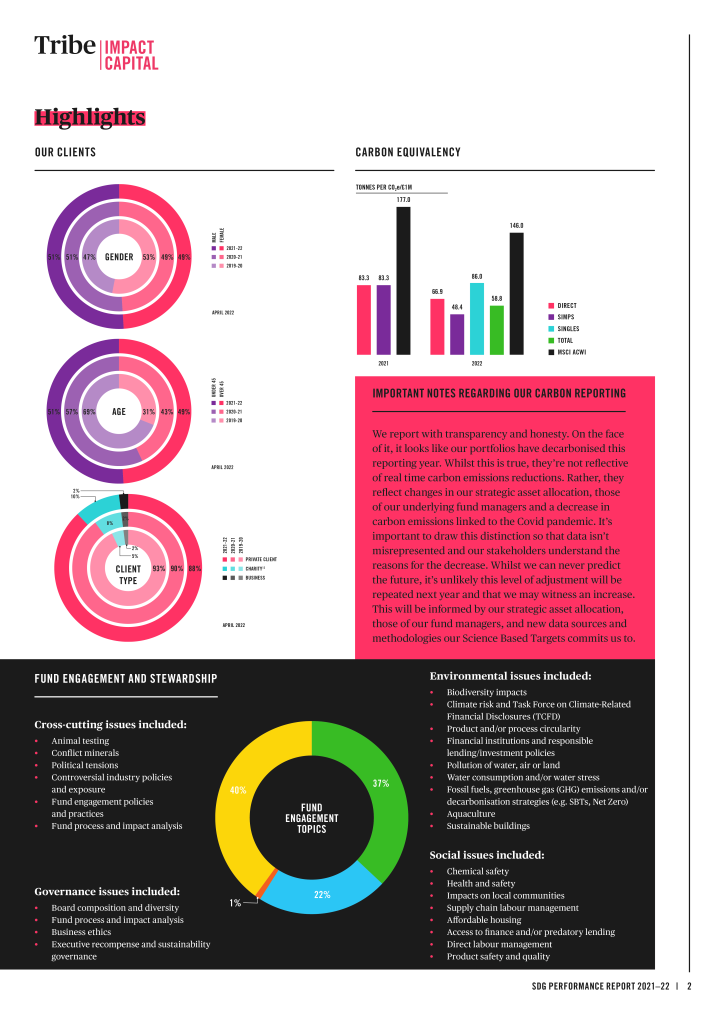

We’re thrilled to report that our assets under management (AUM) between May 2021 and April 2022 doubled again. All our assets remain 100% managed for social and environmental impact.

Our fund stewardship reporting remains unchanged from last year and in line with commitments made on our single line reporting and ownership. We’ve taken the decision to report this separately and at calendar year end, in line with a full year’s worth of voting under our new custody platform.

Last year we committed to becoming a Future Fit Pioneer 5 and to report on our progress in the first half of this reporting year. The Future Fit Business Benchmark (FFBB) included 23 “Break-Even Goals” and a complementary set of indicators for businesses to use to assess alignment with the UN SDGs. It also defined 24 “Positive Pursuits” which are activities a business with purpose can pursue to create a regenerative impact on people and planet. Unfortunately, due to changes with the Future Fit Business resulted in the benchmark being put into organisational stasis for the time being.

Finance is at a crossroads. The announcement of the Glasgow Financial Alliance for Net Zero (GFANZ) at COP 26 during the reporting year was a much welcome development from the sector at large. However, questions remain regarding the scale, pace and robustness of what GFANZ has committed to. But the signals were clear; finance is stepping up to play more of a leading role in the much-needed transition. We were delighted to become a founding member of the newly formed UK B Corps Finance Working Group along with other B Corps in finance. The Group delivered a powerful message at COP 26 for the rest of the finance industry; change your corporate governance to become stakeholder aligned with our support. Collaborations like this are important in showing the strength and unity in mission driven businesses, but also the power of becoming aligned with broader stakeholder interests as a business model. Since COP 26, the group has grown further and more work streams are now underway including Net Zero best practice, as well as the campaign call on governance.

Alongside this, we also became an official spokesperson for the Better Business Act 6 , something we believe passionately in. We also continued our support and membership of the Business Declares network 7 . Both support our deep desire to inform system change through action and future fitting policy and regulation.

We hope you enjoy this year’s report. It’s been some time in the making given our work with the SBTI team. Our desire to want to present climate data in this report that has been checked by a third party, in this case, Green Element (to whom we are extremely grateful), has meant a delay in our reporting timetable. We look forward to updating you on our progress with SBTI validation and target setting next year.

Footnotes

-

01 May 2021 – 31 April 2022Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote