ESG vs impact investing: The difference and why it matters

According to the Financial Conduct Authority’s Financial Lives Survey, over 70% of people in the UK who already have investments want their money to do ‘some good’ alongside generating a financial return. 1

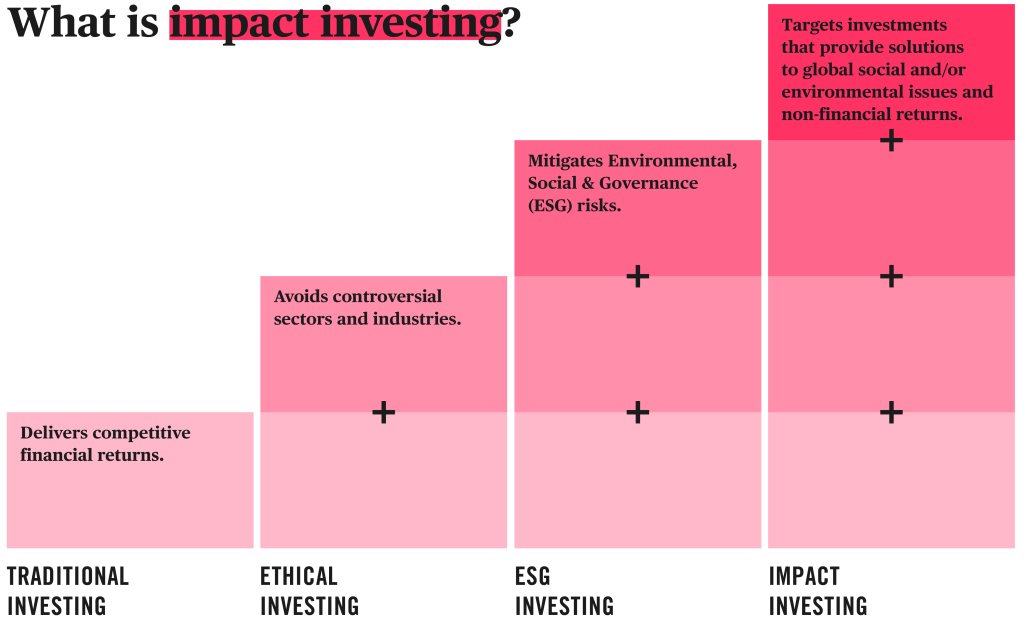

Traditional investing focuses on competitive returns, but for many, that’s no longer enough. Investors increasingly want their invested money to reflect their values – funding businesses working toward improving the lives of people and the planet.

This has led to a rise in more sustainable approaches, like environmental, social and governance (ESG) investing and impact investing. While these strategies share some features, like a long-term view and a focus on ethics and sustainability, they aren’t the same. Understanding the differences between them is key to making informed decisions about where your money goes and what it supports.

What’s ESG investing?

ESG investing is a strategy that’s centred around risk management and corporate responsibility. This method of investing looks to integrate

Environmental, Social and Governance (ESG)

ESG can be applied broadly across sectors and has a variety of approaches in terms of applying the core principles. Some common approaches include:

-

– excluding companies or sectors that don’t align with certain values (e.g., tobacco, weapons, fossil fuels)

Negative screen

A process or “screen” that excludes securities from being included in portfolios based on specific criteria. For example based on an ethical or social concern. - Positive screening – investing in companies that perform better than peers on ESG metrics, even within controversial sectors

- ESG integration – incorporating ESG factors into traditional financial analysis to identify material risks and opportunities

- Thematic investing – focusing on specific ESG themes like clean energy, gender diversity, or water sustainability

- Shareholder engagement – using investor influence to push companies toward better ESG practices through voting and dialogue

ESG investing is commonly applied in public

Equity

Fixed income

However, public markets come with some limitations:

- Limited influence – investors are often minority shareholders with limited power to drive change.

- Data gaps – ESG ratings can be inconsistent, opaque, and backwards-looking.

- Greenwashing risk – companies may overstate their ESG credentials without meaningful action.

- No guarantee of impact – ESG investing may reduce harm, but it doesn’t necessarily create intentional, measurable positive change.

ESG-labelled funds are widely available and easy to access. They can help investors begin their journey into sustainable finance, applying some ethical considerations without straying far from traditional finance. That said, while ESG helps investors avoid some harm, it doesn’t actively help them do good. There can be a lack of

Intentionality

Additionality

You might also like: Is full divestment the only path to sustainable investing?

What’s impact investing?

Impact investing is an investment strategy that aims to generate positive, measurable social and environmental outcomes alongside a financial return. Unlike ESG investing, which focuses on managing risk, impact investing is about actively contributing to solutions.

Genuine sustainability, a fundamental basis of impact investing, involves detailed engagement with a business’s products and services, along with its history. Data needs to be acquired from multiple sources and a range of specialists. An impact strategy can’t be passive; it requires active and considered management along with a clear understanding of an industry in order to understand the potential challenges.

Impact investing spans a wide range of global issues. Climate action, health and well-being, access to quality education, financial inclusion and gender equality are just a few of the types of issues impact investing may target. Because impact investing is outcomes based, tracking against these issues is a major part of the reporting process. Outcomes are tracked using metrics like:

- Tonnes of CO₂ avoided

- Number of women in senior leadership positions

- Number of patients treated

Another distinction between ESG and impact investing is that impact investing can occur in both public and private markets, but is most common in private markets. In private markets, investors can directly fund mission-driven businesses and have the ability to steward and engage with these companies.

You might also like: Investing in SDGs: Guiding global impact and sustainable returns

Our approach

As

Impact

At Tribe, we solely invest in businesses working for the benefit of society and the planet. We use the United Nations

UN Sustainable Development Goals (UN SDGs)

Our approach goes beyond negative screens and ruling out companies with bad practices. We take a much more detailed view of which opportunities may have a positive impact as well as generate financial returns.

We look at a combination of quantitative performance and qualitative due diligence while looking for the most well-run companies, and then we continue to manage and monitor our portfolios against clearly defined objectives, stewardship progress and key risk parameters.

We believe that investment has an important role to play in overcoming the range of challenges the world faces. This might look like a fund that helps combat poverty by providing small loans to entrepreneurs in emerging economies, or a wildlife conservation bond dedicated to protecting and increasing black rhino populations whilst supporting local communities.

You might also like: Ethical screens: what are they and how do we use them?

Conclusion

The evolution of impact investing comes from the demand for capital to be a genuine force for good – rather than just a shield against risk. ESG can be a useful compass and a meaningful way to get started with sustainable finance, but it doesn’t chart the full journey. It’s important to know the difference between ESG and impact investing, and to consider what you want your wealth to achieve.

ESG investing has an inconsistent definition, and the way the principles of ESG are applied can vary. ESG investing also relies on third-party collected data, and often doesn’t go far enough in redirecting capital in public markets to where it’s most urgently needed to solve the environmental and social problems we face as a society.

Impact investing focuses on addressing major social and environmental challenges while generating financial returns. From climate change to gender equality, sustainable cities to government policy change, the range of these challenges is vast, but deeply interconnected.

New to impact investing but want to explore further?

Footnotes

-

Financial Conduct Authority. (May 2025). Financial Lives 2024 survey.Scroll to footnote