Q3 2020 performance

We head into Q4 with Covid-19 cases on the rise again and looming uncertainty around the US elections. There are, however, some encouraging developments for impact investors as a result of several policy announcements in Q3 from around the globe. We believe these announcements have helped drive further relative outperformance for Tribe’s bespoke model portfolios versus our comparable universe (as defined by ARC). We’re optimistic that these developments will further strengthen our long-term investment and impact themes – which include more responsible and sustainable corporate behaviour.

Leading the way in early Summer was the EU with the outline of the EU Recovery Fund. The €750bn funding package has a significant focus on a “green” recovery and has directly benefitted many of our

Equity

Renewable energy

In August, US Presidential candidate Joe Biden outlined his Green New Deal (GND) economic proposal. The plan outlines a pledge to achieve a 100% clean energy economy and reaches net-zero emissions no later than 2050. The plan establishes enforcement mechanisms that includes milestone targets no later than the end of his first term in 2025. Biden’s climate and environmental justice proposal will make a federal investment of $1.7 trillion over the next ten years, leveraging additional private sector and state and local investments to total an investment of more than $5 trillion to facilitate their pledge. Whilst we don’t position our portfolios for a specific outcome of any election, we believe that some of the policy commitments outlined in the GND will be pursued at state level regardless of the national result.

At the end of September, China’s President Xi Jinping, announced at the UN General Assembly a commitment to achieve national carbon neutrality by 2060, with a goal to have CO2 emissions peak by the end of the 2020s. The announcement came directly after a rebuke from President Trump that China was “not interested in the environment”. Despite Trump himself having presided over a general easing of domestic environmental protections, including the proposed withdrawal from the Paris Climate Accord at the end of this year. EU officials sought some

Credit

We believe that Q3 may be seen as a landmark quarter, when policy makers across the globe dialled up their climate commitments, spurred on by the need to invest into a green economic recovery post Covid-19.

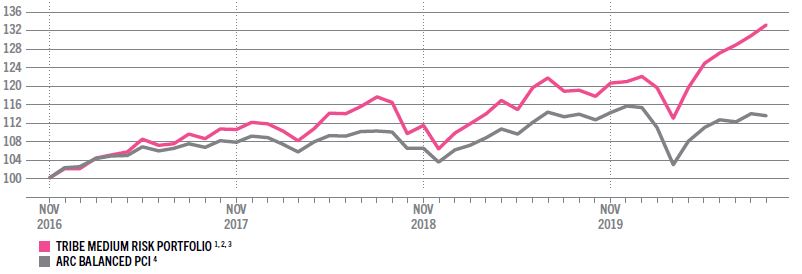

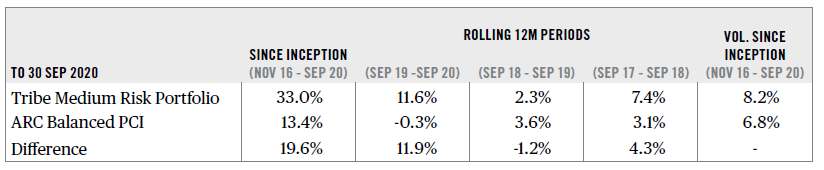

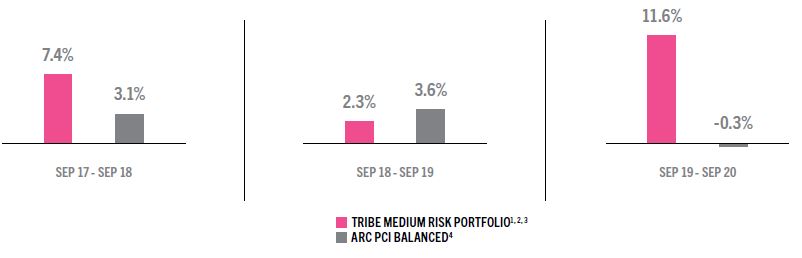

Return Metrics

Our medium risk bespoke model portfolio’s outperformance increased in Q3, relative to ARC. Year-to-date, the portfolio is up almost 10%, an 11.7% outperformance relative to ARC.

1

. Despite the sharp sell-off in

Equity

Asset class

Discrete Annual Performance 3

Future Policy Alignment

We’re optimistic about the potential of more coordinated global policy, which will work to support the climatic goals that have already been reflected by the management teams of many of our underlying investments. We believe that these commitments will service as a solid investment foundation for these same businesses going forward. As a consequence, we continue to see a balanced investment opportunity for our portfolios. We remain mindful of near-term risks such as and the US election, focusing on diversifying exposures and investment themes.

1 Sources: Bloomberg and ARC data 1st January to 30th September

2 The performance of actual portfolios linked to the medium risk bespoke model may differ once we have taken into consideration a client’s individual portfolio requirements

3 Returns are calculated net of Tribe’s management fee and third-party fund costs. Dividends are paid on an accrued basis

4 From 31 October 2019 we changed our industry performance benchmark from the ARC Steady Growth to the ARC Balanced benchmark. The ARC Balanced benchmark is more reflective of our long-term Strategic Asset Allocation and is more suitable for portfolios with relative risk to

Equity

5 Year-to-date refers to 31th December 2019 – 30th September 2020

Footnotes

-

Sources: Bloomberg and ARC data 1st January to 30th SeptemberScroll to footnote

-

The performance of actual portfolios linked to the medium risk bespoke model may differ once we have taken into consideration a client’s individual portfolio requirementsScroll to footnote

-

Bloomberg and ARC data 1st January to 30th SeptemberScroll to footnote