Q2 2020 performance

Australian bushfires, record global temperatures, the Black Lives Matter movement and Covid-19; H1 2020 has seen environmental, societal and financial disruption on an unprecedented scale. This has presented an opportunity for companies and investors to take pause and consider how things could change and how things should change.

Disruption accelerates change. The increase in societal and environmental stress over the past decade has gradually been gaining investor attention, corporate participation and policy leadership in areas of responsible and sustainable practice. The events of Q1 have accelerated this attentions towards better business practices.

Q2 saw a rapid and broad-based rebound in

Equity

Credit

More than ever, impact investing is providing a targeted way to channel wealth into building back a better society and environment. Identifying the companies, managers and solutions that are working towards maintaining a floor for society’s needs while respecting the environmental ceiling. Our methodology supports those companies investing in the “base of the pyramid”. For example, the provision of health, housing, utilities and food, sectors where earnings have been generally protected and where we have held overweight positions.

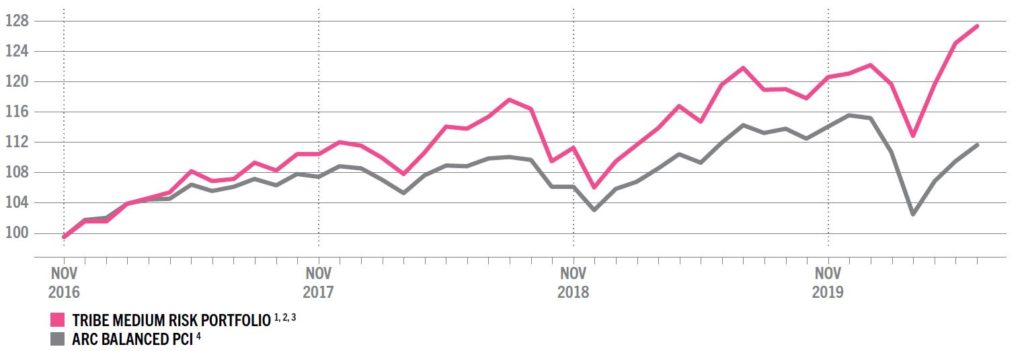

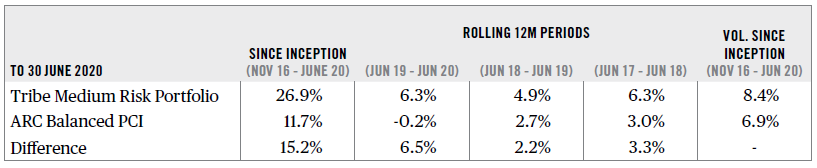

Our medium risk bespoke model portfolio has outperformed more than 15%* since November 2016, relative to ARC¹, with more than half of this outperformance occurring in H1 2020 through Covid-19 related market turmoil.

Return Metrics*

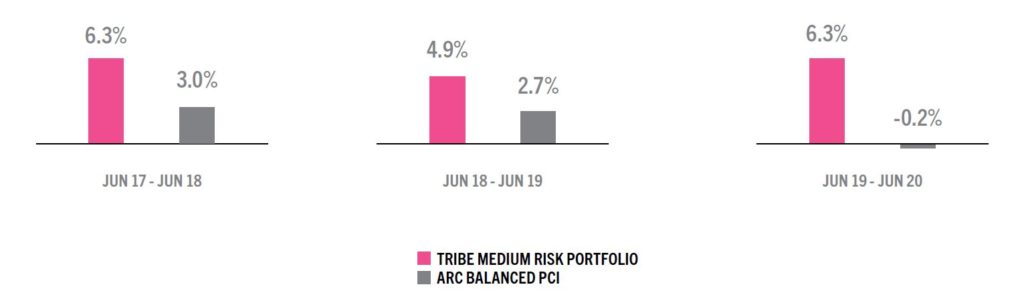

Discrete annual performance 4

Looking forward

By embedding impact considerations into our investment decisions, we remain focused on the longer term as we move through a particularly volatile start to 2020. This focus has prevented the temptation towards knee jerk selling, and reaffirmed the strength of our conviction in backing particular sustainable themes such as clean energy transition and the circular economy.

As we move into H2, we remain disciplined and committed to our longer-term investment themes. We continue to look for ways to diversify our exposure to new opportunities, especially where there is a strong structural growth theme and low correlation to the wider

Equity

Credit

Footnotes

-

The performance of actual portfolios linked to the medium risk bespoke model may differ once we have taken into consideration a client’s individual portfolio requirementsScroll to footnote

-

Returns are calculated net of Tribe’s management fee and third-party fund costs. Dividends are paid on an accrued basisScroll to footnote

-

From 31 October 2019 we changed our industry performance benchmark from the ARC Steady Growth to the ARC Balanced benchmark. The ARC Balanced benchmark is more reflective of our long-term Strategic Asset Allocation and is more suitable for portfolios with relative risk to [tooltip]equity[/tooltip] markets of between 40-60%Scroll to footnote

-

Sources: Bloomberg and ARC data H1 Jan 1st to June 30thScroll to footnote