Legal & regulatory information

Terms of use

Before using this website, you should read the following important information carefully. This information governs your use of this website and, by using this website, you indicate that you accept these terms of use and that you agree to be bound by them. If you do not agree, please do not use our website. The content of this website, including these terms, may be changed by us without notice, and you should check this page from time to time.

Regulatory information

Tribe Impact Capital LLP is authorised and regulated by the Financial Conduct Authority (“FCA). Our FCA registration details are set out in the FCA Register under Firm Reference number 756411 (www.fca.org.uk). Tribe Impact Capital LLP is registered in England and Wales (registered number OC411984) and our registered office is 52 Jermyn street, London SW1Y 6LX.

Suitability

The information contained in this website should not be regarded as advice or an offer, invitation or solicitation to enter into any financial obligation, activity or promotion of any kind as defined by the Financial Services and Markets Act 2000. The provision of any investment services and products, whether or not mentioned in this website, may not always be suitable for an investor, and we recommend that any potential investor consults a financial adviser before entering into any investment contract. Investors should be aware that past performance is not an indication of future performance, the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invested.

Services

Our Advisory and Discretionary Portfolio Management services are restricted to providing you with specialist expertise and advice on the management of investment portfolios. As a firm we are able to source our investment solutions from the whole of market, and we are not tied to any products or providers. However, we will not consider your wider financial planning and pension requirements, unless you wish us to do so, when we will refer you to an alternative service provider.

Privacy policy

Please see privacy policy.

Jurisdiction

Tribes website is intended for persons in the United Kingdom only, and its content should not be regarded as an invitation or inducement to engage in investment activity, as defined by the Financial Services and Markets Act 2000 to persons in any other jurisdiction. These terms of use shall be governed by and construed in accordance with English law.

Copyright

You may use information on this website for your own personal reference only. All information and material on this website is copyrighted to Tribe Impact Capital LLP.

You are not permitted to publish, transmit, or otherwise reproduce this information, in whole or in part, in any format to any third party without the express written consent of Tribe. In addition, you are not permitted to alter, obscure, or remove any copyright, trademark or any other notices that are provided to you in connection with the information. The information on this website is provided in good faith and no representation, guarantee or warranty is made by us as to its accuracy. Tribe reserves the right, at any time and from time to time, in the interests of its own editorial discretion and business judgment to add, modify, or remove any of the information.

We shall not be liable for any loss or damage arising out of the use of or reliance on the information contained in our website. This does not affect our duty or liability to you which we have under the Financial Services and Markets Act 2000 or under the regulatory system. Tribe accepts no liability for information contained within websites provided by third parties that may have links to or from our website.

Security

Tribe makes no warranty whatsoever to you, express or implied, regarding the security of the site, including with respect to the ability of unauthorized persons to intercept or access information transmitted by you through this service.

Systems

As a result of high Internet traffic, transmission problems, systems capacity limitations, and other problems, you may, at times, experience difficulty accessing the Web site or communicating with Tribe through the Internet or other electronic and wireless services. Any computer system or other electronic device, whether, it is yours, an Internet service provider’s or Tribe’s can experience unanticipated outages or slowdowns, or have capacity limitations.

Complaint procedure

We take care to maintain high standards of service. If we are aware of client concerns or unease, we give high priority to resolving the matter as quickly as possible. To assist with this process we have prepared procedures to ensure that complaints are handled fairly and within reasonable timescales. The below is a summary of our complaint handling procedure. A copy of our full procedure is available on request.

How to make a complaint

If you wish to make a complaint in relation to the services we provide to you, please contact our Head of Compliance, Olivia Shaw, at:

Mail: 52 Jermyn Street, London, SW1Y 6LX

Email: olivias@tribeimpactcapital.com

Phone: 0203 745 7073

You can complain in writing, by telephone, or via email.

What happens after I have complained?

Upon receipt of a complaint, a senior person who, where possible is independent of the case, will investigate the complaint. You will be given the name and contact details of the person dealing with your complaint. We will aim to resolve the complaint as quickly as possible. The person investigating your complaint will:

- Initiate a record and file of your complaint; and

- Acknowledge your complaint as soon as is reasonably practical after the receipt of your complaint. This will generally be within 3 business days of receipt.

The acknowledgement may, especially in the case of an oral complaint, set out the nature of the complaint and may request further clarification if necessary.

Your complaint will be investigated using our files together with reports from other parties if relevant. We may also write to your if further information is required.

We will keep you informed of the progress of the complaint investigation. After 8 weeks, if a final response letter has not already been sent to you, you will receive a final response letter detailing our conclusions and resolution to the complaint. If we are not in a position to make a final response, we will give the reasons for the delay and will indicate when we expect to be able to provide a full response.

What if I am still not satisfied?

Within our final response letter to you, we will include details of the Financial Ombudsman Service (the “FOS”). Provided you are an eligible complainant, you have the right to refer a complaint to the FOS if you are not satisfied with our response. Any referral to the FOS must be made within 6 months of receiving our final response. You can contact the FOS at:

Mail: The Financial Ombudsman Service: Exchange Tower, London, E14 9SR

Email: complaint.info@financial-ombudsman.org.uk

Website: www.financial-ombudsman.org.uk

Phone: 0800 023 4567

Further information about the FOS and whether you are an eligible complainant can be found at www.financial-ombudsman.org.uk or by calling 0800 023 4567.

Annual Disclosures – Year ending April 2023

Introduction

Tribe Impact Capital LLP (“Tribe” or the “Firm”) is required to make annual disclosures in accordance with MIFIDPRU 8. Tribe is a SNI firm and its core business involves providing discretionary and advisory services to retail and professional clients.

Risk Management Objectives

Tribe’s Board (“Board”) is the governing body of the Firm and, as such, is ultimately responsible for the application of a robust internal risk management regime. The Board is aware of the potential harms to clients, market and firm arising from its business activities, principally those being related to the investment management and advisory services Tribe provides to customers.

In order to manage risks, the Board receives regular management information on the Firm’s financial and operational performance. In addition, the Board continuously monitors and, if necessary, enhances, the Firm’s Business Model, directs the Internal Capital Adequacy and Risk Assessment (‘ICARA’) process and receives other significant regulatory intelligence which, in aggregate, provide the requisite information to identify trends and issues particularly in relation to:

- The adequacy of its own funds; and

- The adequacy of its liquid resources enabling the firm to meet its liabilities as they fall due.

In each of these areas the Board’s approach is risk averse in order to ensure that Tribe has sufficient capital and liquidity to remain in business. To this end, Tribe monitors its actual and near-term capital and liquidity positions on a monthly basis and carries out stress testing of its medium-term financial plans as part of its ICARA process in order to validate the adequacy of its forecast capital and liquidity resources.

Tribe’s risk management framework reflects the FCA requirement that it must manage a number of different categories of risk. Our framework involves an annual programme of risk identification which involves all of the business, as well as monthly board reviews of our risks, their likelihood and impact. These include liquidity risk, operational risk, credit risk, reputational risk, business risk, market risk, investment risk, interest rate risk and concentration risk.

Liquidity risk

Tribe faces two types of liquidity risk. As a business Tribe generates cash from its operations and holds sufficient cash reserves to meet the continued operating needs of the business. This is supported by a robust budgeting and forecasting process which has the full involvement of the management team. Secondly, where appropriate, our clients’ portfolios may include investments that are less liquid. We manage this risk by careful monitoring of these securities, as well as our clients’ portfolios and broader objectives.

Operational risk

Operational risk is defined as the potential risk of financial loss or impairment to reputation resulting from inadequate or failed internal processes and systems. Whilst Tribe does not handle client money or assets, and we use third party, FCA-regulated custodians, this is still a risk that is closely monitored by our operations team and the management team. The focus is on both the services provided to us by our third-party providers (including trading, custody, and reporting) as well as our own internal operational processes.

Credit risk

Tribe does not undertake any lending activity with clients. The main credit risk for Tribe relates to the deduction of fees due from its clients. However, the investment mandate authorises a deduction of Tribe’s management fees from the client monies held at their custodian and provides for assets to be sold in the event that there is insufficient cash to meet the fees due.

Reputational risk

Tribe is potentially exposed to reputational risk in the event that clients’ funds are invested in unsuitable investments. All investments are reviewed by Tribe’s investment and impact teams and any recommendations or securities in our clients’ portfolios must come from the Approved List.

Business risk

Tribe’s business risk principally takes the form of a fall in assets under management either due to a market downturn or a loss of clients through reputational risk that leads to a significant reduction in revenue. To mitigate business risk, the Finance team regularly analyses various different economic scenarios to model the impact of economic downturns on our financial position. The exposure to business risk is hedged, to a degree, by clients’ portfolios having significant exposure to both bonds and equities.

Market risk

Tribe does not have any foreign exchange exposures nor does it have permission to engage in proprietary trading book activities and are therefore not directly exposed to market risk. Clients’ portfolios are linked to the markets and these are addressed within investment risk. Company revenues are linked to market movements and these have been addressed within business risk.

Investment risk

As an investment management firm we recognise that the investment and impact performance of our clients’ portfolios is a risk which must be actively managed and monitored. We have a number of internal processes for this purpose, which involve multiple internal teams.

Interest rate risk

Tribe has no borrowings and no direct exposure to interest rate risk. We have an indirect exposure through our clients’ portfolios, which is covered by our business risk.

Concentration risk

Tribe has a wide client base and diverse revenue streams and is not reliant on the income generated by a single client or single revenue stream.

Governance Arrangements

The partners of Tribe recognise and accept that the Board, as the governing body of the Firm, has responsibility for the implementation of governance arrangements that assure its effective and prudent management. Tribe considers that the existing arrangement whereby the Board meets quarterly satisfies this requirement. Whilst the Board readily acknowledges its collective risk management responsibility, it should be noted that the partners are also held accountable for specific areas of delivery under the Senior Managers and Certification Regime. The Board implements its collective responsibility through the policies and procedures that it approves and cascades to the partners and employees of Tribe. The implementation of these policies and procedures not only protects the reputation of the Firm but also serves to promote market integrity and the interests of Tribe clients. The effectiveness and accuracy of their execution is validated by ongoing monitoring which either validates their successful practical application or identifies failures that can be promptly remediated. The Board frequently reviews and updates the Firm’s harms register, and it carries out an extensive ICARA process at least annually.

Board Diversity

Tribe ensures that its directors (executive partners), in aggregate, have a sufficient range of skills and experience to manage a business of Tribe’s nature, scale and complexity. Whilst the Board believes that its current composition is fit for purpose at the Firm’s current scale, if additional executive partners are appointed in future they will be assessed on the criterion that the individual recruited would have the skills and experience that complement those of the existing partners.

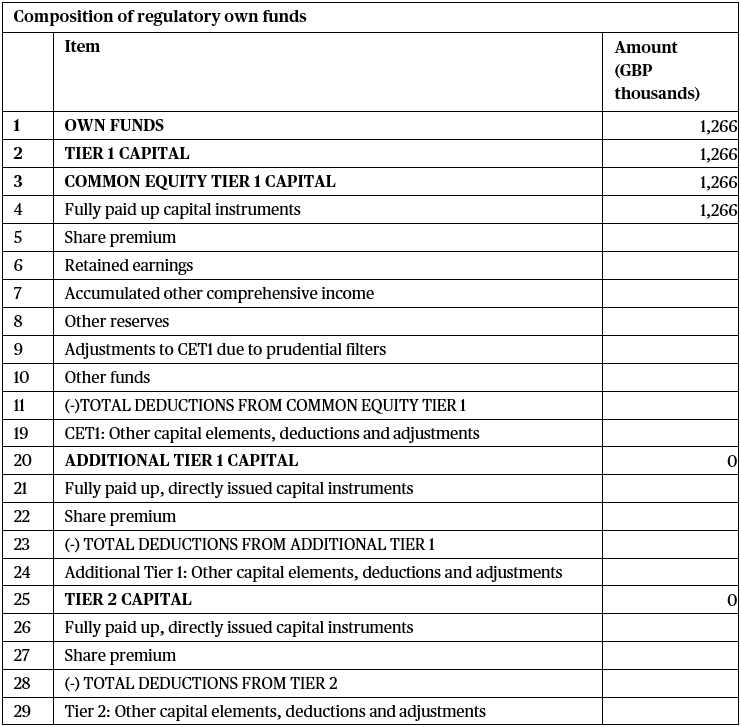

Own Funds

Remuneration

Tribe is a MIFID investment firm, authorised by the Financial Conduct Authority (‘FCA’) to carry on the regulated activities of managing investments. A consequence of its regulatory status is that the Firm must comply with the relevant provisions of the MIFIDPRU Remuneration Code set out in SYSC 19g of the FCA Handbook, a key element of which is that its remuneration practices are consistent with responsible risk management.

Tribe’s Approach to Remuneration

Tribe remunerates its employees through payment of fixed and variable remuneration. The levels of fixed remuneration are determined by the Board and relate to basic wages and salaries plus proportionate pension contributions. In setting levels of fixed remuneration for particular categories of employee, it is the Board’s intention that the amounts paid should properly reflect the complexity and responsibility of the roles performed and be consistent with the rates of pay for similar positions in peer group competitor firms.

Tribe operates a variable remuneration scheme in the form of a staff bonus pool that is intended to incentivise superior performance across the business without creating a conflicting motivation for reckless or inappropriate behaviour.

Tribe defines ‘variable remuneration’ as non-contractual payments or provision of benefits made directly to Tribe employees. All employees, irrespective of gender, are eligible to receive variable remuneration, subject to acceptable performance. The levels of variable remuneration paid are determined by the Board. Payment of variable remuneration is made in cash and is discretionary for all employees. Tribe does not guarantee payment of variable remuneration and it is Tribe’s policy that no variable remuneration is paid if it would inappropriately dilute the Firm’s liquid or capital resources.

Partners

All Partners receive a draw from the Partnership as their remuneration if there has been sufficient profit during the year. The levels of remuneration paid are determined by the Board. Payment of remuneration is made in cash. Tribe does not guarantee payment of draw and it is Tribe’s policy that no draw is paid if it would inappropriately dilute the Firm’s liquid or capital resources.

Tribe and the UK stewardship code

Tribe complies with the UK Stewardship Code (the “Code”) which was issued by the Financial Reporting Council in July 2010 and amended in September 2012 in respect of our activities for professional clients. “Stewardship” means the way in which we look after our clients’ best interests and manage their investments by actively monitoring the companies in which we invest on their behalf.

Although Tribe primarily manages the assets of natural persons who are classified as retail investors, this policy statement focuses instead on our professional clients and summarises how we apply the seven principles of the Code.

- Institutional investors should publicly disclose their policy on how they will discharge their stewardship responsibilities.

Tribe manages client assets on a bespoke basis, seeking to maximise investment returns for each client. It is central to our investment process to consider each company’s ability to create, sustain and protect value. Therefore, we continually assess the performance of the management of companies in which we have invested on behalf of our clients and whether or not our client’s interests are being best served. Effective monitoring of investee companies is fundamental to fulfilling our responsibility of our clients. An investment is unlikely to be made if we have significant concerns about either management or matters of corporate governance.

From time to time where deemed appropriate, discretionary proxy voting decisions may be taken internally. This is done with our client’s best interests in mind at all times.

- Institutional investors should have a robust policy on managing conflicts of interest in relation to stewardship and this policy should be publicly disclosed.

Tribe maintains a robust policy on managing conflicts of interest which is designed to ensure its decisions are taken wholly in the interest of its clients. Tribe aims to ensure that all potential and actual conflicts are identified, recorded, evaluated, managed and monitored.

A summary of Tribe’s conflicts of interest policy is available to clients upon request.

- Institutional investors should monitor their investee companies.

Comprehensive and continuous research and monitoring of investee companies is fundamental to Tribe’s investment process as our investment strategy typically looks to long term investment rather than continual turnover of clients’ portfolio holdings. Monitoring typically occurs though financial reporting, general meetings, in connection with news and announcements and research Tribe may conduct when looking into investment ideas or reviewing our approved lists of securities.

- Institutional investors should establish clear guidelines on when and how they will escalate their activities as a method of protecting and enhancing shareholder value.

Where we have concerns about the performance or strategy of an investee company or where we have reason to believe that our client’s rights as shareholders are being compromised in any way, we will escalate our engagement with the investee company’s management and take any trading decisions accordingly.

- Institutional investors should be willing to act collectively with other investors where appropriate.

Tribe’s long term investment strategy and research process mean that it will rarely be necessary for such collective action to taken. However, if such collective action is deemed to be in the best interests of our clients, it will be carefully considered and may be taken accordingly.

- Institutional investors should have a clear policy on voting and disclosure of voting activity.

Where we take voting decisions on behalf of our clients, we will always act in a manner consistent with our client’s best interests. Where necessary or appropriate, we endeavour to engage with investee companies. Records of our votes on behalf of particular clients are available to those clients upon request.

We do not let stock or use proxy voting services.

- Institutional investors should report periodically on their stewardship and voting activities.

We regularly report investment activity to our clients, and where it is considered relevant to the client, we will report details of our stewardship and voting activities.

Cookie policy

Please see cookie policy.