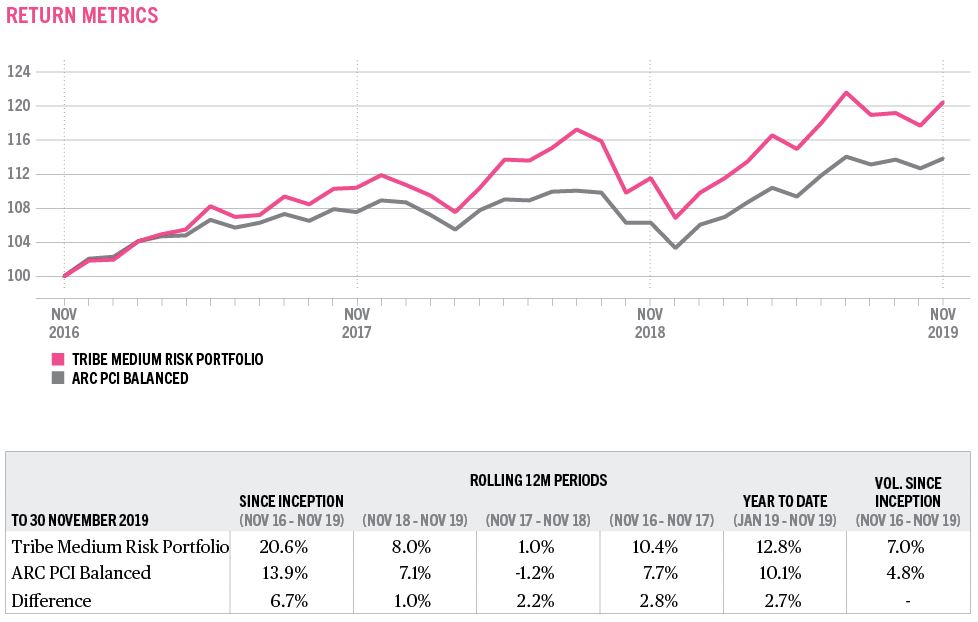

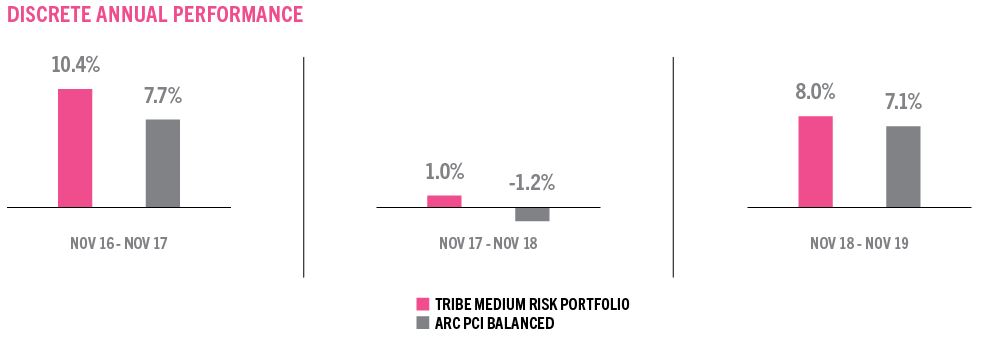

Three-year performance

On 30th November, 2019 we celebrated three years of running active portfolios. Whilst past performance is not a good indicator of the future, we believe the results highlight both the strength of our investment process over this multi-year period and that impact investing can deliver a strong risk adjusted performance. Investing in well-run businesses trying to solve major challenges means you can do well and do good.

Our Medium Risk Portfolio returned 20.6% (net of fees) 1 over the three-year period, compared to the “ARC PCI Balanced Benchmark”, which returned 13.9%. 2 (ARC benchmarks are calculated by collecting actual performance from over 50 investment managers).

Volatility

The impact

In addition to financial performance, we seek to generate positive social and environmental returns with our portfolios. By investing £1m in the Medium Risk Portfolio rather than in a representative basket of the

investable universe,

3

you would have saved 60 tons of

Carbon dioxide (CO2)

Our process and philosophy

We seek to distinguish ourselves by building multi-asset class portfolios for clients that deliver financial returns in line with their values and the positive change they want to see in the world. Our Medium Risk Portfolio comprises an actively managed selection of our best ideas within a “balanced” allocation to Equities, Bonds, Alternative Investments and Cash. Our investment selection process incorporates a rigorous

Twin-lens

Equity

Sustainability

What we invested in

Looking across the sectors we invest in, our overweight to Healthcare was the biggest contributor to our performance over the three years. We naturally tend not to invest in fossil fuel providers, who make up the bulk of the Energy sector (many of the

Renewable energy

Sustainability

How that played out

Our FCA authorisation commenced in November 2016, which was slightly inopportune timing in terms of launching an Impact Investing strategy. Following the election of President Trump in the US, some stocks (for example fossil fuel based energy) rallied, while renewables suffered. The performance on the first day was the third worst to date (-1.5%). Since then, the Medium Risk Portfolio has performed well, helped by a strong overall

Equity

Asset class

Equity

Volatility

Equity

Microfinance

Social housing

Looking out to 2030

We have a long-term nature to our investment horizon, not least as it’s heavily informed by the UN SDGs (which are anchored in a 2030 timetable). We couple this with a focus on businesses seeking to provide solutions to environmental and social challenges, that we believe are well positioned to continue to thrive. These companies should succeed in tapping into certain secular growth opportunities, such as organic food, the circular economy and

Renewable energy

Climate crisis

Footnotes

-

This performance is net of Tribe’s [tooltip]discretionary[/tooltip] management fees, trading, custody, VAT and any underlying third party fund chargesScroll to footnote

-

We changed our benchmark on 31 October, 2019 from the ARC Steady Growth to the ARC Balanced benchmark as this is more reflective of both our long term Strategic Asset Allocation that the ARC Balanced Benchmark is more suitable for portfolios with a relative risk to [tooltip]equity[/tooltip] markets of between 40-60%Scroll to footnote

-

As represented by MSCI ACWIScroll to footnote

-

Data from Tribe, MSCI & US EPA Carbon Calculator January 2020. Based on emissions [tooltip]scope 1[/tooltip] and 2 of covered listed equities (60.5% of Medium Risk Portfolio)Scroll to footnote

-

As represented by MSCI All Country World IndexScroll to footnote

-

We estimate that Facebook, Amazon, Apple, Netflix and Google (Alphabet) delivered around a quarter of the S&P’s total return from Nov16-Nov19 and currently makes up 14% of the indexScroll to footnote