Donor Advised Fund (DAF)

Why have a DAF?

We work with a range of clients, managing investments for positive impact. More and more, investors are wanting to incorporate impact into their investment objectives for both their personal and charitable wealth. Some clients do this by establishing a charity – a traditional choice for many who are looking for ways to administer their giving. However, for those who perhaps lack the capacity and time to set up a charity, there is an efficient structure that can support investors’ charitable endeavours. It’s called a

Donor Advised Fund (DAF)

What is a DAF?

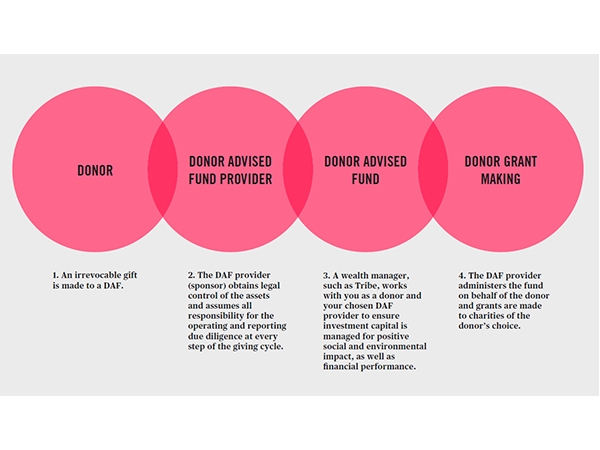

A DAF is an easy to establish philanthropic vehicle which facilitates charitable giving on behalf of donors. Donors can take several forms including individuals, families, or companies. DAFs are created under an umbrella charity of a sponsoring organisation which administers the fund on behalf of the donor.

A wealth manager, such as Tribe, can work with the DAF provider and you as the donor, to manage the assets you have allocated to the DAF for positive social and environmental impact; At the same time growing the assets for financial return which enables the DAFs ongoing

Grant

How does DAF operate

- Donors select a DAF provider and contribute assets to their DAF: we can help a donor find a DAF provider or work with their preferred DAF provider. Once this relationship is established, donors fund their DAF account with shares or cash. There is usually a minimum initial donation required to open the account, which varies depending on DAF provider. Donors can ‘top up’ their DAF with additional contributions whenever they like, however, it’s important to note that all donations are irrevocable once made. The DAF provider is now the legal owner of the assets.

- The fund grows in value: we work with several DAF providers managing the assets held within a DAF for both financial growth and positive impact. We take a collaborative approach, working with the DAF provider and donor to create an impactful portfolio for financial and impact returns. By taking an impact investing approach, the donor’s philanthropic goals can still be met while investing the DAF assets in investments which are delivering social, environmental and investment returns: which can increase capital for grant giving. This holistic approach facilitates maximum charitable and portfolio impact.

- Grants are given: the donor instructs the DAF provider to make donations to charities of their choice. The DAF provider will manage this entire giving process, assuming all responsibility for reporting, administration, and due diligence on the organisations the donor wishes to “gift” or donate to.

How do DAFs sit within the charity market?

DAFs are growing in numbers both in the UK and overseas. They are becoming a popular alternative to establishing a charity by those looking for a cost and time efficient solution to manage their

Philanthropy

How are DAFs similar to charities?

For donors, DAFs offer many of the same tax advantages of a charity:

Gift Aid

Capital Gains Tax (CGT)

Also, DAFs can be set up reasonably quickly and Charities Commission authorisation is not required. Donors can also name a DAF as they wish and use the name publicly, or they can choose to remain anonymous.

How does Tribe invest DAFs?

Tribe provides impactful investment solutions for the assets held in DAFs. We work with DAF providers and their donors to build and manage portfolios that further and deepen a DAF’s philanthropic goals.

At Tribe, every investment is assessed for both its financial and impact credentials: the potential monetary returns it may deliver, as well as its social and environmental outcomes. This isn’t just about negative screening, it doesn’t simply mean ruling out investing in companies with bad practices. Instead, our approach takes a much more detailed view of which opportunities may have a positive impact. While some wealth managers offer impact investing as a small part of a broader portfolio, Tribe solely invests in businesses working for the benefit of society and the planet. This means donors can be assured 100% of their investments are being managed for financial growth, values alignment, and the change they want to see in the world.

The client case study below highlights the benefits of applying an impact lens to a DAF

Donor

Julia Davies founded We Have the POWER at the beginning of 2020 with part of the sale proceeds from her company Osprey Europe. Passionate about protecting the environment her entire life, Julia’s commitment became stronger once she had children. As well as supporting environmental charities and campaigns, Julia also invests in start-up companies providing solutions to tackle climate change.

Why did you decide to open a DAF rather than a charity account?

“Having been a commercial lawyer in the past, I know just how challenging it can be for charities to deal with the amount of bureaucracy they are legally obliged to complete. To have the most impact on the causes I am most passionate about supporting, a DAF account gives me the flexibility and ability to act more quickly than a charity account would, without as much red tape.“

What has your DAF account allowed you to do?

“It’s allowed me to allocate a share of my business sale (Osprey) to charitable donations which are eligible to receive

Gift Aid

Why is it important for you to have an impact wealth manager managing your DAF?

“It’s important that the funds in my DAF account are invested sustainably, in accordance with my ethics until such time I donate them fully to charity. Having an impact wealth manager ensures investment for positive impact and maximises the value back to me and therefore to the charities I support.“

What would you tell someone considering opening an impact focused DAF account?

“I would recommend opening an impact focused DAF account to anyone who wants to create more impact with their wealth – beyond that created from the end charitable donation. There are less costs due to reduced administration and associated costs versus running and administering your own charity. Another advantage is it frees up time to enable more conversations with organisations, groups and companies delivering solutions to the world’s greatest problems.“

Footnotes

-

¹NPT Annual report 2020, extracted 17.02.2021Scroll to footnote

-

NPT Annual report 2020, extracted 17.02.202Scroll to footnote