Change-makers' portfolio: Sustainable fixed income investing

In today’s investment landscape, sustainable

Fixed income

Understanding sustainable fixed income investing

Sustainable fixed income investing involves lending money to entities committed to creating positive impact, with the aim of getting your investment back with interest.

The debt market, which includes the bond market, is the marketplace where fixed income securities are traded. The bond market is vast, boasting a valuation of $133 trillion as of 2023. 1

Investible debt encompasses various types of issuers—corporate, municipal, and sovereign bonds—all converging within the fixed income asset class. Fixed income investing is also an innovative space for those looking to make an impact with their investments.

The appeal of fixed income

Fixed income investments are known for their lower risk credentials and more stable returns compared to

Equity

This stability is crucial for investors seeking to diversify their portfolios while focusing on

Sustainability

In short, fixed income investments serve three pivotal roles in public market portfolios:

- Diversifying away from equities

- Preserving capital

- Generating income

Driving change through fixed income investments

Beyond the three roles above, fixed income can also contribute to sustainability and impact performance.

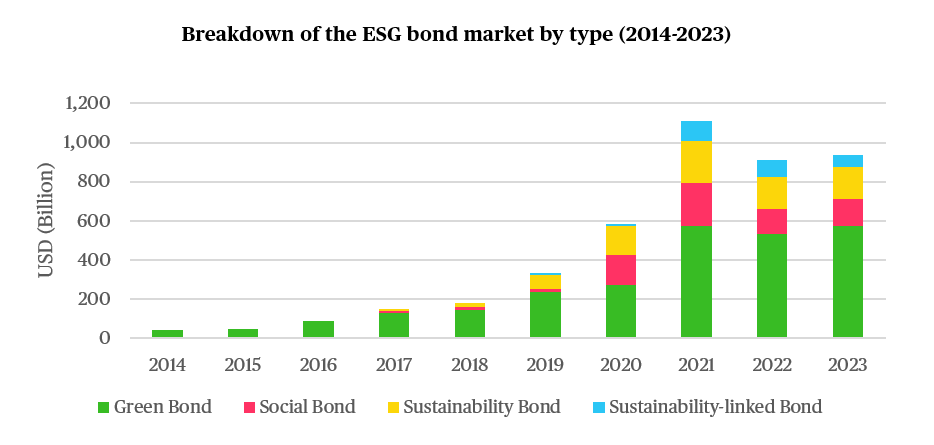

Sustainable fixed income investing goes beyond financial returns, enabling investors to contribute to sustainable objectives, through instruments such as Green, Social, Sustainability, and Sustainability-linked bonds (GSSSBs). Each of the four GSSSBs is tailored to achieve specific environmental and social outcomes.

For example, the bonds might finance projects aimed at environmental conservation, social development, or governance reforms.

With green bonds, for instance, funds are directed towards

Renewable energy

Internationally recognised guidelines, such as the Green Bond Principles 3 and the Sustainability-Linked Bond Principles 4 by the International Capital Market Association, ensure these sustainable debt structures are optimally designed.

The guidelines include recommended structuring features, disclosures, and reporting requirements. The guidelines enhance market competency, lower development costs for businesses, and aim to convey benefits in a consistent and comparable format.

The expanding GSSSB market

The market for these bonds is rapidly expanding, with impact bond issuance reaching $939 billion in 2023. 5 This growth signifies a broader recognition of utilising finance as a tool for achieving the United Nations Sustainable Development Goals (UN SDGs).

Notable examples of GSSSB initiatives include:

- Chile’s green sovereign bond aimed at catalysing a national low-carbon transition

- NatWest’s socially linked bond supporting UK-based women-led enterprises

- The World Bank’s conservation-focused sustainable development bond

Chart source: Green bonds reached new heights in 2023, Bloomberg

Engaging effectively in sustainable fixed income

Investors in sustainable fixed income investing can engage with bond issuers to encourage adherence to

Environmental, Social and Governance (ESG)

Tribe’s experience underscores the effectiveness of such engagement, demonstrating how investors can influence positive changes aligned with the

UN Sustainable Development Goals (UN SDGs)

The Paris Agreement

There are two ways investors can actively engage with the entities they invest in: before the bond is issued, ensuring that sustainability goals are part of the deal, or after, holding issuers accountable for their promises.

The former is known as primary engagement (‘pre-issuance’), and the latter represents secondary (‘post issuance’) market engagement.

Primary versus secondary engagement

Primary engagement allows investors to influence the inclusion of ESG-linked commitments such as carbon reduction targets before issuance. Making commitments explicit and enshrined in company finance is thought to improve the likelihood of success by tying sustainability performance (i.e.,

Carbon intensity

Through secondary engagement, investors focus on upholding contractual obligations and integrating new ESG or sustainability conditions during refinancing (the process of replacing old debt with new).

Successful engagement in both primary and secondary markets is critical for supporting solutions-oriented companies that contribute to the

UN Sustainable Development Goals (UN SDGs)

The Paris Agreement

At Tribe, we’ve witnessed successful engagement on both primary and secondary fixed income investments. Successful primary engagements involve investor collaboration before release, leading to innovative new bonds such as the NatWest and World Bank examples we outlined earlier.

An example of secondary engagement we’ve witnessed included investors pursuing legal action due to an underlying company regressing on their board gender diversity commitments.

The company in question regressed on a board diversity target stated in a bond following its acquisition by another firm. The investor leveraged positive change in board gender diversity by threatening to sue the company if they didn’t honour their commitment.

In the end, this active investor engagement was enough to push the company towards a more gender-diverse board.

Conclusion: Wrapping up sustainable fixed income investing

Fixed income

Sustainable fixed income investing offers a dual benefit: it provides a stable income and plays a role in funding projects that align with investors’ values towards a greener and more equitable world.

By choosing to invest in green bonds and other impact bonds, individuals can make a difference, championing sustainability through their financial decisions.

Footnotes

-

Book-to-Market, mispricing, and the cross-section of corporate bond returns, European Capital Markets Institute (ECMI)Scroll to footnote

- Scroll to footnote

-

Green Bond Principles (GBP), ICMA GroupScroll to footnote

-

Sustainability-Linked Bond Principles (SLBP), ICMA GroupScroll to footnote

-

Green bonds reached new heights in 2023, BloombergScroll to footnote

- Scroll to footnote