Investing in sustainable tech

We have a simple investment philosophy; we’re looking for well-run businesses solving big global challenges. You may, or may not (depending on your perspective), be surprised to find hardly any of the mega-cap technology stocks that have driven US market performance over the last two decades in Tribe portfolios.

Why is this? Technology and digital inclusion are fundamental to achieve the UN Sustainable Development Goals (SDGs). Some of the larger tech names, however, have complex value chains and can present concerns around data security and privacy, pricing, transparency and engagement, e-waste and supply chain management. But, at over 20% of the total index, Information Technology (IT) is easily the largest sector within the equity universe 1 and can’t be dismissed in its entirety.

Despite very good performance over the last 20 years, technology stocks have struggled recently. Many technology companies that thrived during the work-from-home boom of the pandemic, have failed to adapt to the post-covid economy. Over the last 18 months, there’s been a correction as rising inflation and interest rates have dampened long term growth expectations. This has been particularly difficult for technology names, the value of which is intrinsically aligned to future growth potential. Unprofitable, high growth tech names have been hit particularly hard, along with mega-cap FAANG stocks 2 , which shed around $2.5 trillion in market cap value in 2022 3 .

Recent reports and news articles detailing downscaling and redundancies have highlighted to what extent the correction has hit some tech companies. Meta, for example, has let go 13% of its workforce 4 . Regulatory requirements for the sector, like anti-trust fines, have strengthened. Since 2015, tech companies including Google, Apple, Meta, Amazon, and Qualcomm have collectively received anti-trust fines totalling more than $30 billion 5 . For many technology products that are free at point of consumption (but arguably allows the end user themselves to become the product), data security and privacy regulations have also been rising. The introduction of General Data Protection Regulation (GDPR) across the EU in 2018 heralded a significant change in technology regulations. Today, there are now more than 100 countries that have privacy and/or data protection laws and by the end of 2024 it is expected 75% of the world’s population will be covered under privacy regulations 6 . Where once the possibilities for growth seemed endless for technology companies, market conditions are starting to change the way some companies are having to operate.

Despite these headwinds, however, there are many reasons for sustainable investors to be optimistic when it comes to investing in technology. Whilst it’s possible to be dismissive of some of the impact narratives in big tech, technological improvements are central to sustainable development and a low-carbon economy. The ability of tech to digitalise tasks and create central ledgers of digital information can increase the efficacy and efficiency of decision marking. The Internet of Things (IoT) is a good example of this, as are smart grids. There’s increased demand from consumers and regulators for net zero targets and transition pathways. Technology has a role to play in underpinning systems that will lead to the decarbonisation of our economy. Open source, open data and collaboration are needed to drive this change. Digitisation and digitalisation, big data and analytical developments are also important for a more sustainable economy, as well as being critical drivers of economic growth. Challenges around access and affordability exist, but if well managed, tech can provide interesting opportunities.

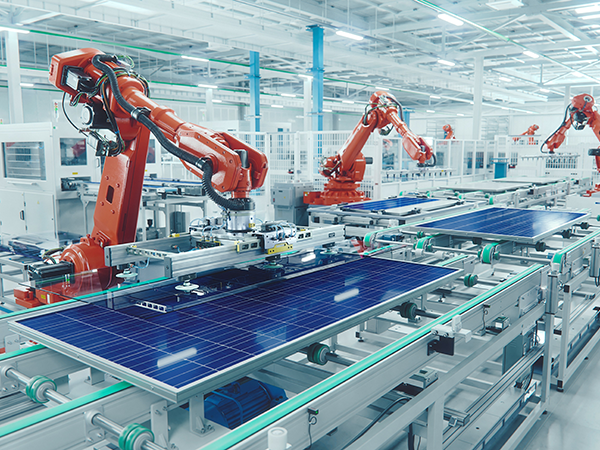

There’s also a demographic imperative to focus on technology that helps manage the transition to an ageing economy. In many

economies like Japan, Europe and now China

7

the ageing population will, in time, reduce the supply of available labour. At the same time, it will produce higher demands on core infrastructure, particularly healthcare. Technology, once again, will be at the core of tackling this demographic change through robotics, artificial intelligence (AI) and machine learning. To continue to improve productivity, investing in efficiency-based technology will help to pick up some of the economic slack, while biotech and medical advances will cater to the growing healthcare requirements. Technology for education, the use of blockchain in disaster response, and technology for democracy and societal participation all provide potential for the technology sector to do well and do good.

Fear of new technologies is not new and has been a concern since

the Luddite rebellion in the 1800s

8

. The counterargument has always been that technology creates more jobs than it removes. According to the Institute for the Future, the pace of labour market change is expected to be so rapid that

85% of jobs that will exist in 2030 don’t exist today

9

. While we believe the new sustainable economy should ultimately create more jobs than it removes, there’s always the need to remain vigilant to the issues that can arise throughout technology’s value chain.

Efficiency is a key tenet of sustainability and central to our belief that technology will continue to drive the global economy. We may no longer be in a cycle that compensates speculative pre-profit companies but the outlook for technology, particularly within the broader environmental and social meta themes, remains very compelling.

Footnotes

- Scroll to footnote

-

“FAANG” is an acronym that refers to the stocks of five prominent American technology companies: Meta (META) (formerly known as Facebook), Amazon (AMZN), Apple (AAPL), Netflix (NFLX); and Alphabet (GOOG) (formerly known as Google)Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote