How we’re positioned for Europe’s energy market recovery

The dramatic price rises for European energy that accompanied Russia’s invasion of Ukraine in early 2022 has given way to an equally dramatic fall in prices. This has meant that one month forward futures contracts for natural gas are now lower than where they began in 2022. What has enabled Europe to withstand Putin’s weaponization of energy exports and what has this meant for our investment positioning at Tribe, from both a macro and sector specific perspective?

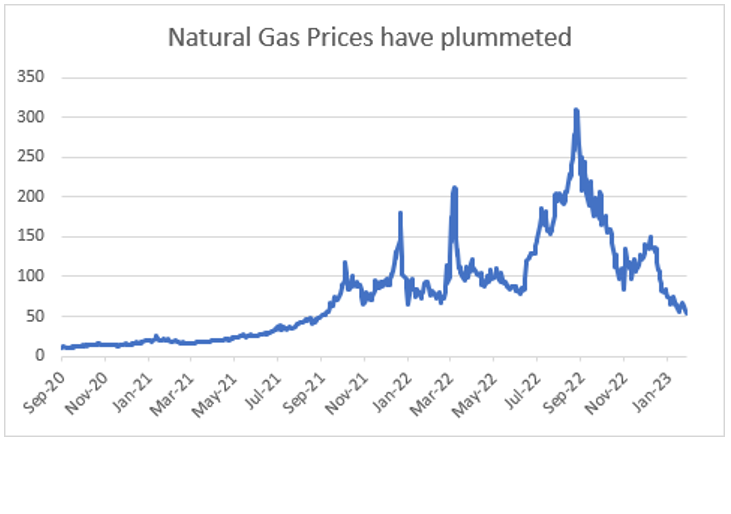

The graph below shows how quickly natural gas prices have fallen from their August 2022 highs. Concerns from industrial consumers and investors alike peaked at this time, fuelled by the possibility of winter shortages, compounded by the disruption of the Nord Stream 1 gas pipelines in the Baltic Sea, and Russia’s continued reduction in piped natural gas exports.

Source: Bloomberg

The peak in prices also coincided with extreme weather in Europe over summer 2022. The extremely hot and dry conditions led to widespread drought that affected hydro and nuclear production. In 2022, France, Europe’s biggest hydro power producer, suffered a 41% lower cumulative precipitation that could be harnessed for hydro power generation, according to data from Refinitiv 1 .

The high energy prices of mid 2022 wreaked havoc with the European economy. Higher utility prices hit consumers hard, forcing inflation up, with Eurozone Consumer Price Inflation (CPI) peaking in October at 10.6%. This hit the price of government bonds, which fell 18% for the calendar year 2 .

Some of the summer price spike was likely due to aggressive stockpiling in Europe. Storage levels hit 100% in Germany ahead of their winter, above the 80% target, and far higher than the 90% average peak of the last ten years 3 . This strong starting point certainly helped the fall in prices later in the year, and was immediately helped by milder weather, reducing demand for heating gas. It was further supported by a significant decline in demand due to a combination of higher prices (so called demand destruction) and government policy, such as the EU wide commitment to reduce consumption by 15% 4 .

Stockpiles and lower demand have reduced prices, feeding positive sentiment for Europe

The effect is feeding through into the real economy, where gas shortages for Winter 2022/3 are no longer considered likely. So much so, Klaus Mueller, Germany’s Energy Minister, speculated that storage levels may remain above 50% by the end of winter 5 . The increased confidence is also manifesting at macro level; Germany’s Chancellor Olaf Scholz declared on the 17th of January 2023 that he was “convinced” that Germany was no longer in danger of falling into recession 6 . His remarks preceded a January survey by Consensus Economics that predicted the Eurozone bloc would enter recession in 2023. However, in their January update they now expect 0.1% growth over the course of 2023 7 .

In short, Europe has avoided a worst-case scenario of running out or rationing gas for households and/or industry this winter. The pricing reflects this lower level of market stress. This sits well with Tribe’s portfolio positioning, where we currently favour European equities, which have had a strong start in 2023. The STOXX Europe 600 index posted a 6.8% gain for the 26th of January 8 . This could also benefit government funds and certain sovereign bond issuers if it reduces the fiscal deficit. For example, the UK’s Office of Gas and Electricity Markets (OFGEM) household price cap is set to increase to £3,000 for the average household from April this year. According to OFGEM this could be above the market price 9 – with the government standing to save the £13 billion it had earmarked for this subsidy in the next fiscal year.

Storing up problems for next winter?

Despite this, attention is already shifting to winter 2023/24. While forward futures market prices currently don’t reflect any significant increases in the next 12 months, a supply/demand imbalance remains. A recent International Energy Agency (IEA) report outlined natural gas demand is likely to bounce back 10% vs 2022's level 10 . Assuming the relative mildness of 2022 is not repeated, lower prices through the year will reactivate some demand from industry, notably in the fertiliser sector where high prices forced 70% of European production offline in August 2022 11 .

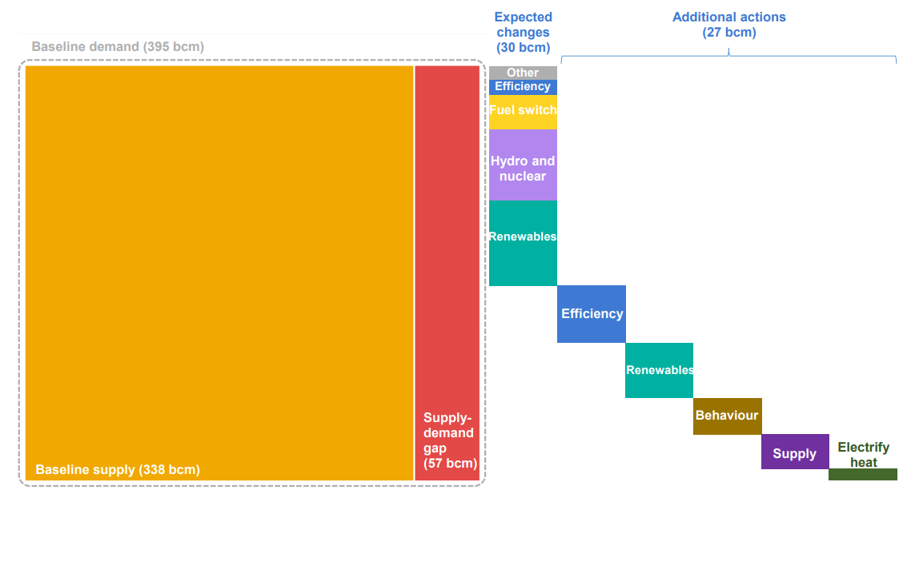

The IEA report anticipates a 57bcm (billions of cubic meters) of natural gas supply / demand imbalance isn’t accounted for in baseline assumptions. Around half or 30bcm will be covered due to changes made throughout 2023, such as an increased contribution from hydro and nuclear as plants come back online.

Additional actions will still be needed to bring the market into balance and help work towards keeping pricing stable.

Improvements in energy usage in buildings, appliances and lighting (insulation, controls, information, and audits) can provide direct and indirect savings of natural gas. The key measure is to raise the percentage of the buildings stock in the European Union that is renovated each year. Currently, only 1% of the EU’s building stock gets renovated annually 12 , but this needs accelerating. Similarly, with lighting and appliances, rebate schemes to swap out old appliances, like what is being done in Switzerland and Ireland’s Optimising Power at Work programme, have realised annual savings of 25% across 300 large buildings 13 . A smart energy street lighting project in Dortmund, Germany has achieved a reduction of 55% in electricity use 14 .

Looking at renewables, while new generating capacity continues to come online in 2023, there’s still 150 GW of solar PV (photovoltaic) projects under various permitting stages in the EU 15 . While most of these projects are in the early stages of permitting, a significant share is waiting for final approval.

Tribe portfolios

This presents an opportunity in terms of sector allocation, especially in renewable energy and energy efficiency – core pillars of Tribe investment portfolios. We have investments across all asset classes in the energy transition, from power generation, storage, distribution and applications such as electric vehicles and electric charging infrastructure. Similarly, we have exposure spanning all aspects of energy efficiency within the built environment from smart heating and insulation to climate control and lighting.

Europe’s economic fortunes have substantially improved in recent weeks with falling energy prices. This has been caused by Europe’s unexpected ability to quickly react to new energy supply and successfully managing downwards demand. We believe that this positive momentum can be sustained, particularly with the European Commission’s REPowerEU and Fit for 55 programmes. They combine the political and environmental imperatives of simultaneously reducing the European Union’s reliance on fossil fuels and the need to reduce greenhouse gas emissions. This has substantially brightened Europe’s recovery prospects, relative to six months ago. It also provides a tactical opportunity within European equities, reinforcing our longer-term investment conviction in the environmental sustainability theme, given the importance of renewable and energy efficient investments to reduce the continent’s vulnerability to high gas prices.

Footnotes

- Scroll to footnote

-

IBoxx Eurozone Sovereign Total Return IndexScroll to footnote

-

BloombergScroll to footnote

- Scroll to footnote

- Scroll to footnote

-

https://www.reuters.com/markets/europe/germany-will-not-fall-into-recession-scholz-tells-bloomberg-tv-2023-01-17/Scroll to footnote

- Scroll to footnote

-

BloombergScroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote

- Scroll to footnote