CPD Series for advisers

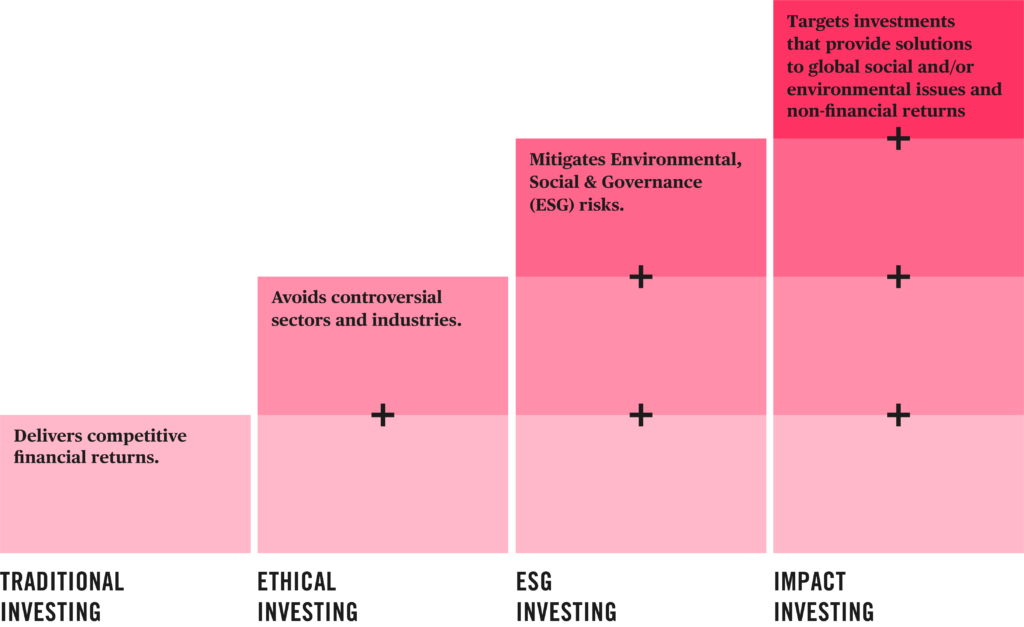

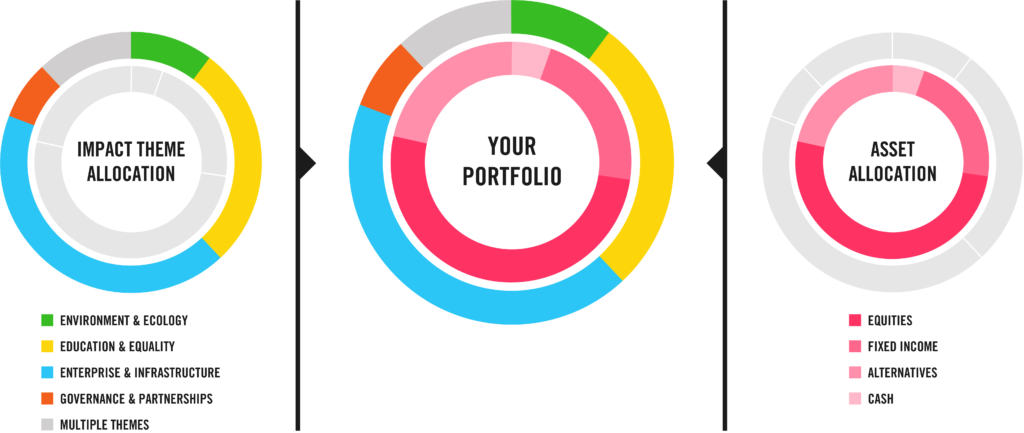

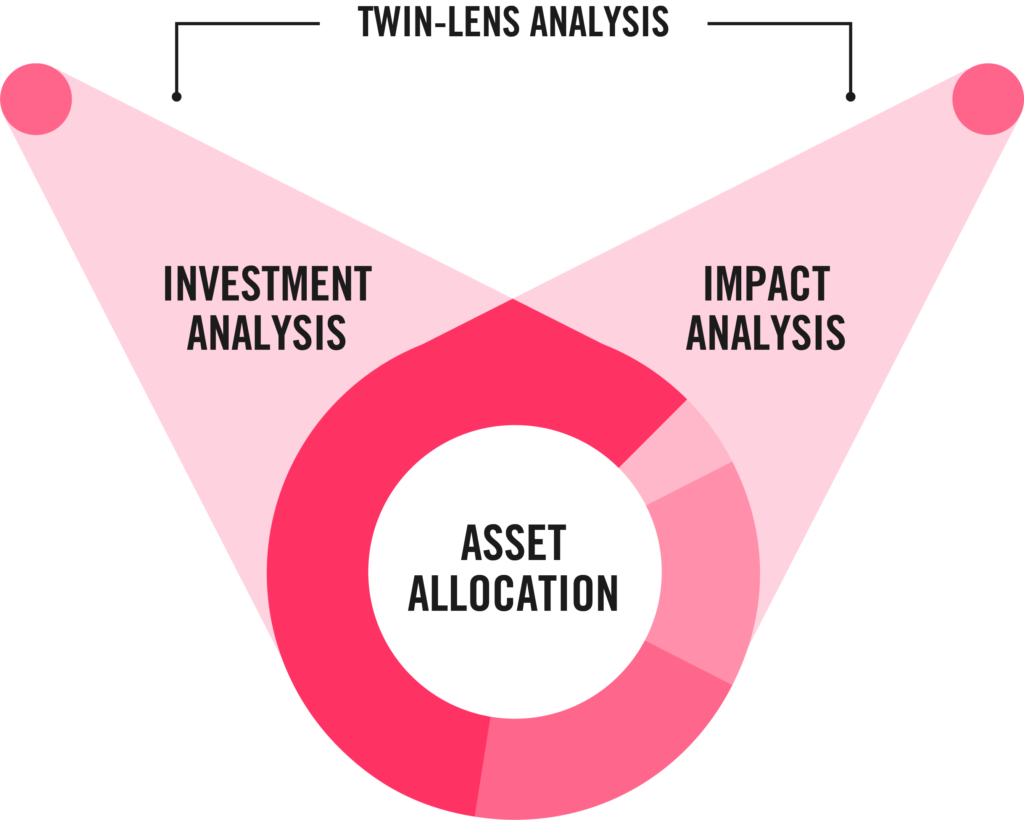

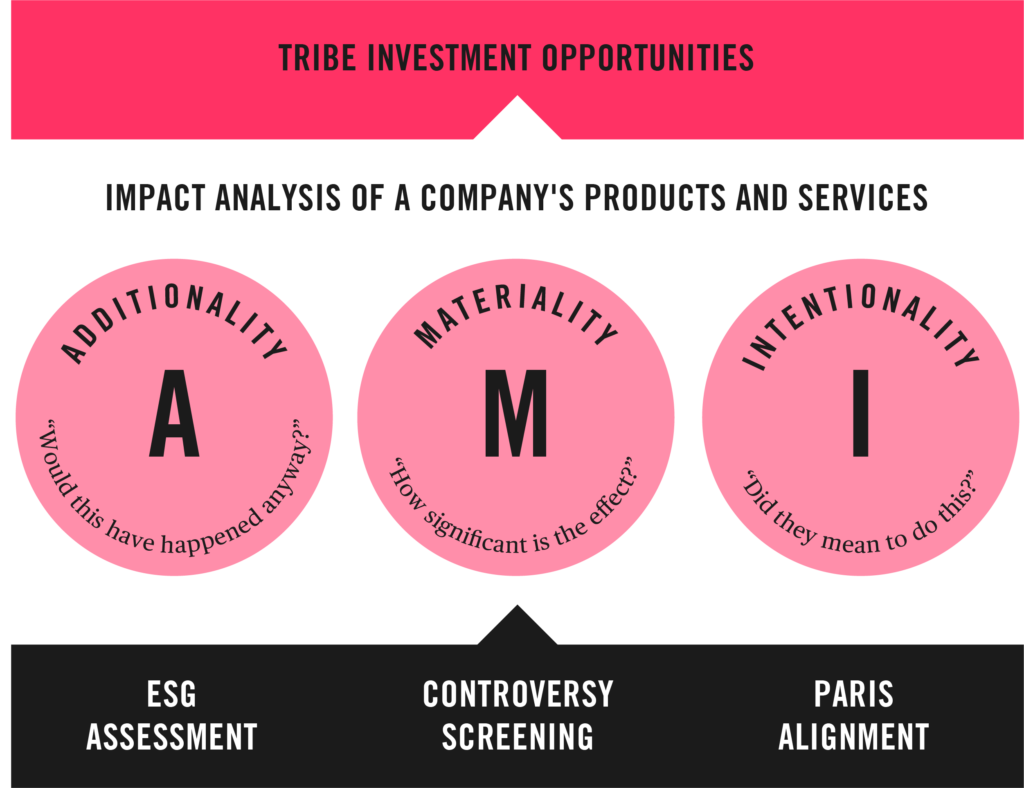

This impact investing series will provide you with information that will enable you to understand more about impact investing and our Sustainable Impact Model Portfolio Service (SIMPS).

We cover a range of topics in this series including what impact investing is and how it differs from other types of investing, our SIMPS asset allocation and fund selection, our SIMPS performance, how we measure impact, as well some impact stories. 1

Our five, 12 minute videos below will provide you with one hour of structured learning Continuing Professional Development (CPD), which is RDR eligible. 2

If you have any questions or topics you would like addressed in future sessions please email them to advisers@tribeimpactcapital.com.

The following training materials have been designed for the sole use of Financial Advisers as part of our SIMPS CPD series.

Register for assessment

To confirm your one hour of structured CPD, please fill out the registration form and take the short assessment quiz by clicking the button below. Once complete, your certificate will be emailed to you.

Footnotes

-

Any companies we talk about in our impact stories are held in one of the funds which make up the SIMPS. Where we have an allocation to alternatives we only include regulated funds, which have daily liquidity and can be marketed to retail clients who are investing in the SIMPS. The target market for SIMPS: financial advisers providing advice services to retail clients who want to access sustainable investments.Scroll to footnote

-

RDR eligibility is determined by each firm, in line with their training requirements and relevance to an individual’s role at the firm.Scroll to footnote