Choosing a purposeful portfolio

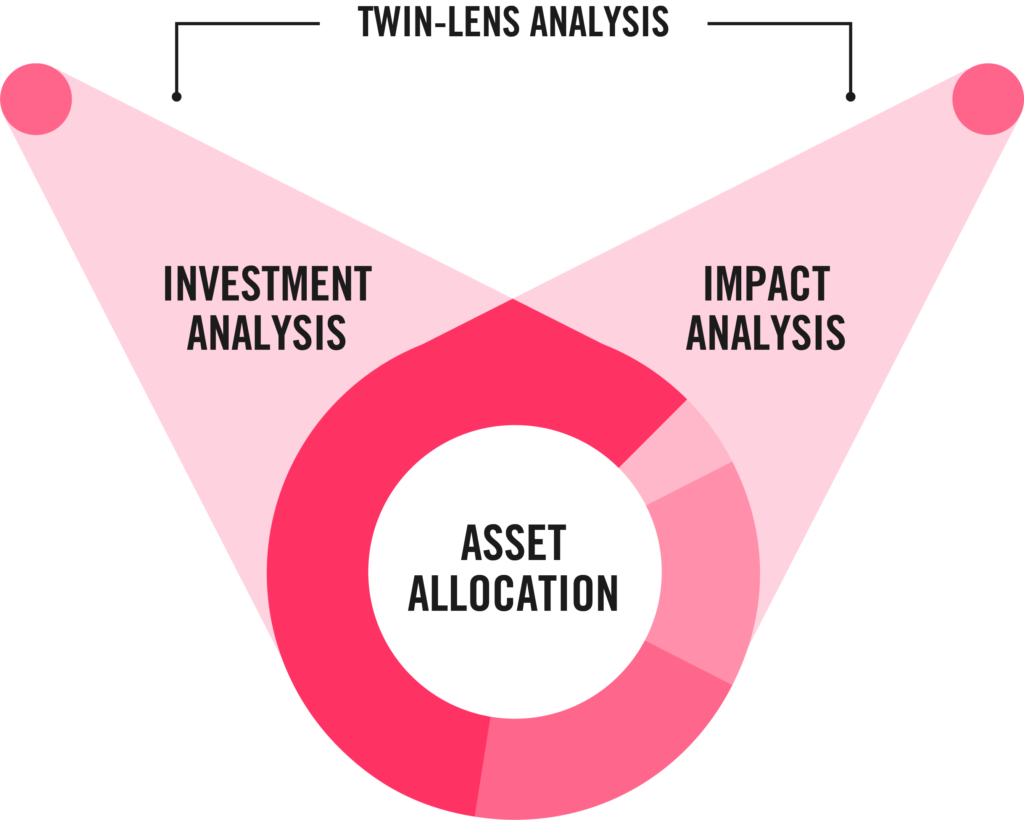

At Tribe, every investment is assessed for both financial performance and the ability to deliver long term positive impact.

We call this our ‘

Twin-lens

This isn’t just about negative screens; it doesn’t simply mean ruling out investing in companies with bad practices. Instead, our approach takes a much more detailed view of which opportunities may have

a positive impact and generate financial returns.

These due diligence processes — of investment and impact — run together in parallel to understand the merits and/or potential risks of an investment. This approach allows us to ensure that the long-term impact goals of the people who invest with us are being met alongside their financial ones.

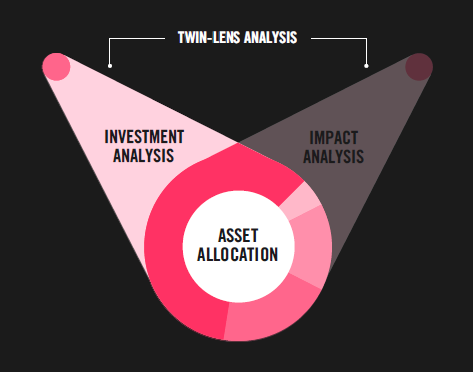

Investment lens

When evaluating each security, we focus on a set of core financial indicators that signal strength, resilience, and long-term potential. These help us understand how well a company is run, how effectively it allocates capital, and whether it can sustain growth over time.

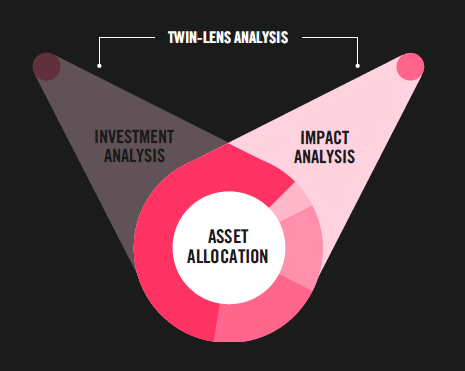

Impact lens

At Tribe, impact means aligning investments to the desired outcomes of the

UN Sustainable Development Goals (UN SDGs)

Join the Tribe

Start realising the potential of your wealth by speaking to one of our Wealth Managers today.