Q1 2020 performance

The COVID-19 pandemic has seen market

Volatility

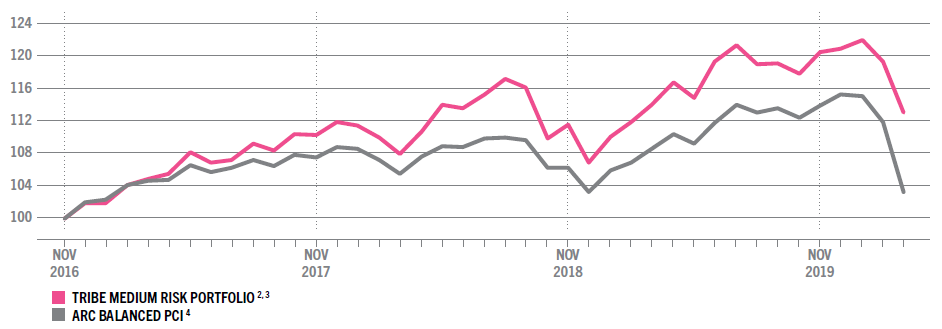

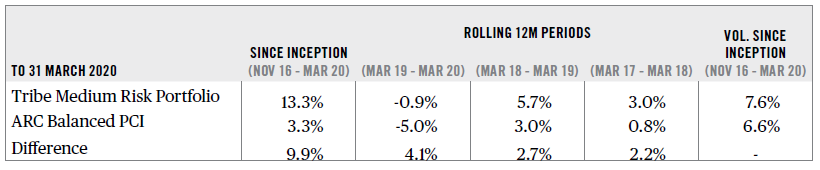

It was only three months ago, we released Tribe’s three-year performance highlighting our investment approach and our strong risk-adjusted performance. Our results showed that we had outperformed within our comparable universe (as defined by ARC) by 6.7% during this period. We attribute this to prioritising investment into companies that are being more thoughtful about future-proofing their earnings, and consequently, their own corporate brands.

We believe by consistently and rigorously adhering to our

Twin-lens

Despite the challenging market conditions, our Q1 2020 performance shows continued relative outperformance, which up until now, has been delivered in the comparatively benign environment of a pre-Covid-19 world. Our medium-risk bespoke model performance fell -6.6% in Q1, versus -10.6% for ARC 1 .

Return metrics

There are three major themes adding to our performance:

- Within our Strategic Asset Allocation, we have a relatively high (21%) exposure to “uncorrelated/alternative” investments which we class as those investments which have revenue and earnings models uncorrelated to the liquid

and

Equity

The universe of traded company shares. Investments can fluctuate according to market conditions, the performance of individual companies and that of the broader equity market.markets. Our investments inCredit

Synonymous with fixed income - securities where the security issuer is obligated to repay investors the amount they borrowed plus an interest margin.andSocial housing

Housing provided for the disadvantaged or with specialised requirements, usually funded by local or central government.recorded gains in the Q1 2020 period. We believe that our focus on impactful and positive investments helps us in uncovering and researching many of these types of opportunities.Battery storage

The capturing and storing of green energy that isn't needed at the time of generation and is saved until it’s needed. - We carry minimal exposure to the travel and tourism industries, as well as the non-staple consumer goods businesses. Our preference is for businesses geared towards solutions addressing and supporting the

. In addition, we benefitted from being overweight, relative to the index, in healthcare and utilities names, which have fared considerably better on a relative basis.

UN Sustainable Development Goals (UN SDGs)

The Sustainable Development Goals (SDGs), also known as the Global Goals, were adopted by the United Nations in 2015 as a universal call to action to end poverty, protect the planet, and ensure that by 2030 all people enjoy peace and prosperity. There are 17 goals. - We have a near zero exposure to fossil fuel energy stocks. While portfolios such as ours received a relative boost from the failure of the Saudi/Russian oil production discussions mid quarter, we note that oil prices were already suffering from lower demand from China based on the Covid-19 disruption before settling at now half their H2 2019 average levels.

The Covid-19 crisis is a test of our investment thesis. This period of heightened market

Volatility

Sustainability

Footnotes

-

ARC data Q1 Jan 1st to March 31stScroll to footnote

-

The performance of actual portfolios linked to the medium risk bespoke model may differ once we have taken into consideration a client’s individual portfolio requirementsScroll to footnote

-

Returns are calculated net of Tribe’s management fee and third-party fund costs. Dividends are paid on an accrued basisScroll to footnote

-

From 31 October 2019 we changed our industry performance benchmark from the ARC Steady Growth to the ARC Balanced benchmark. The ARC Balanced benchmark is more reflective of our long-term Strategic Asset Allocation and is more suitable for portfolios with relative risk to [tooltip]equity[/tooltip] markets of between 40-60%Scroll to footnote